What is Level Life Insurance?

Level life insurance, also known as term life insurance, is a type of life insurance policy that provides a fixed amount of coverage for a set period of time. This means that if you pass away during the term of your policy, your beneficiaries will receive a predetermined payout.

The term level refers to the fact that the amount of coverage remains the same throughout the policy term. This means your beneficiaries will receive the same payout whether you pass away on the first or last day of your policy term.

Why Choose Level Life Insurance?

One of the biggest reasons people choose level life insurance is affordability. Because premiums are based on factors such as age, health, and lifestyle habits, level life insurance policies can be significantly cheaper than other types of life insurance.

Another reason people choose level life insurance is simplicity. With level life insurance, there are simple investment components and cash value options to worry about. You pay your premiums and know your loved ones will be cared for if something happens to you.

Who Should Choose Level Life Insurance?

Level life insurance can be a good option for people looking for affordable coverage for a set period. It’s particularly popular among young families who want to ensure that their children will be financially protected if something happens to them.

It’s also a good option for people who have specific financial obligations they want to protect themselves against. For example, if you have a mortgage or other debt, and you don’t want to burden your loved ones, a level life insurance policy can provide peace of mind.

What Factors Affect the Cost of Level Life Insurance?

The cost of level life insurance can vary depending on several factors. These include age, health, lifestyle habits, occupation, and hobbies.

Younger people and those in good health will pay less for level life insurance than older people or those with pre-existing medical conditions. Similarly, people who engage in risky hobbies or have dangerous occupations may face higher premiums.

How to Choose the Right Level Life Insurance Policy

Choosing the right level life insurance policy requires. By understanding how it works and its benefits, you can make an informed decision when selecting a life insurance policy. Furthermore, comparing different policies empowers you to tailor coverage to your specific needs and secure the best value for your money. Take the time to research and compare policies to ensure you choose the right level of life insurance that provides the financial security your loved ones deserve.

Life insurance is a personal decision, and seeking professional advice is recommended.

Important: All information on this site is of a general nature only. When you compare or complete the assessment online, we will connect you with an advisor who can give you advice at no charge. All advisers who are authorised to use this site, for their marketing purposes, are authorised financial advisers. A full list of advisers and what they can advise on is listed here under our terms & conditions of this site usage.

Latest Post

- Key Person Insurance in New Zealand (2025 Guide)

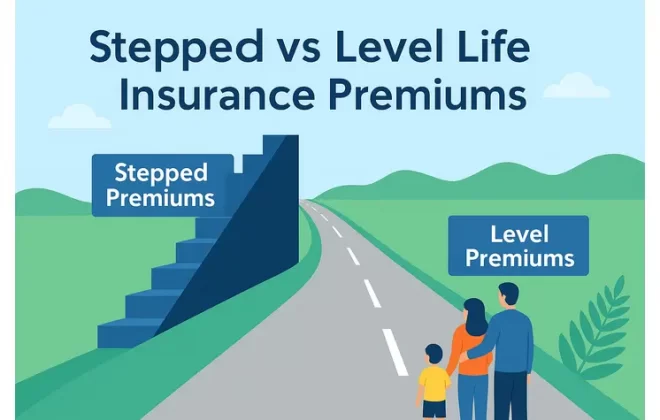

- The Truth About Stepped vs Level Life Insurance Premiums (2025 Guide)

- Total and Permanent Disability (TPD) Insurance in New Zealand

- How Health Affects Life Insurance Premiums in New Zealand 2025

- Top 5 Key Factors To Choose The Best Life Insurance Provider in NZ