The Truth About Stepped vs Level Life Insurance Premiums (2025 Guide)

Table of Contents

ToggleChoosing between stepped vs level life insurance premiums isn’t just a financial decision—it’s about securing your family’s future in a way that aligns with your current needs and long-term goals. For Kiwis, understanding these two premium structures is crucial to ensure you’re not caught off guard by unexpected costs down the line.

In this comprehensive guide, we’ll explore the differences between stepped and level premiums, their pros and cons, and help you determine which option best suits your lifestyle and financial situation.

Key Takeaways at a Glance

- Stepped Premiums: Start lower but increase as you age.

- Level Premiums: Higher initial cost but remain constant over time.

- Hybrid Approach: Combining both can offer flexibility and long-term savings.

- Budgeting: Your choice impacts your financial planning and affordability.

- Life Changes: Consider how your needs may evolve over time.

Ready to explore your options? Compare Quotes Now and find the best fit for your needs.

Stepped vs Level Life Insurance Premiums – The Basics

When choosing life insurance in New Zealand, the premium structure you select—stepped or level—can significantly affect your monthly payments and long-term financial well-being. Understanding the difference is essential for making the right choice for your stage of life and goals.

What Is Stepped Cover?

Stepped premiums (rate-for-age premiums) are recalculated annually based on your age. Since you pose a lower risk when you’re younger, premiums start out cheaper. But they increase yearly as your risk of claiming rises with age, often significantly from your 50s onwards.

This structure is popular among younger Kiwis who want affordable life insurance early in their careers while managing other costs like mortgages or raising children.

⭐ Key Features of Stepped Premiums

- Premiums increase every year as you age.

- Offered by all major NZ insurers (e.g., AIA, Partners Life).

- Great for short-to-medium-term needs

- It can often be converted to level cover early (usually within 3–5 years).

✅ Pros of Stepped Premiums

- Affordable Entry Point

A 30-year-old might pay as little as $25-40 monthly for $500,000 in coverage, making it accessible even to those on modest incomes.

- Flexible for Short-Term Needs

Perfect for those who only need cover while paying off debt or raising young children.

- Easy Access to Cover Early

Helps you get started with protection now, even if you plan to switch later.

- Switching Options Available

Some insurers let you move to level premiums without re-underwriting if done early.

❌ Cons of Stepped Premiums

- Significant Increases Over Time

That same $25/month premium could jump to $200–$300+/month by your 60s.

- Unpredictable Budgeting

Premium hikes vary yearly, making long-term planning difficult.

- High Risk of Policy Cancellation

About 85% of stepped policies are cancelled before claims, due to rising costs.(industry average) - More Expensive Long-Term

If held for more than 10–15 years, you’ll likely pay more than you would with level cover.

👨👩👧 Example:

Hemi (33), Auckland – Young Family & Mortgage

Hemi has just bought a $1.0m home and has a toddler. He selects stepped premiums for a $500,000 cover at $30/month—affordable for now.

He plans to reassess in 5 years and switch to level once his income grows.

🔵 What Is Level Cover?

Definition:

Level premiums are locked in when you take out the policy and remain fixed for the duration of your chosen term (e.g., 10 years, or to age 65 or 80). Your insurer spreads the risk over time, which means you pay more upfront but avoid the compounding cost increases of stepped cover.

Level cover best suits people who value budget certainty, plan to hold their policy long-term, or are approaching retirement.

⭐ Key Features of Level Premiums

- Premiums remain the same throughout the agreed term.

- Helps with long-term financial and retirement planning.

- We may revert to stepped pricing after the term ends (if it is not renewed).

- Better suited to policies you expect to keep for 10+ years.

✅ Pros of Level Premiums

- Predictable, Fixed Cost

You know precisely what you’ll pay, even as you age.

- Great for Long-Term Budgeting

Ideal for retirees or those on fixed incomes. - Cost Savings Over Time

Level cover is often cheaper overall if the policy lasts 10+ years. - No Surprises from Health Changes

Your premium doesn’t increase if you develop medical issues after taking out the policy.

❌ Cons of Level Premiums

- Higher Starting Cost

You may pay 50% to 100% more than the step in the first few years.

- Not Ideal for Short-Term Policies

You may overpay if you only need cover for 3–5 years. - May Revert at End of Term

Some policies switch to stepped premiums at age 65, 70, or 80 unless renewed—often at much higher rates.

👵 Example:

Margaret (52), Christchurch – Planning for Retirement

Margaret wants $250,000 coverage until she turns 80. She pays $125/month with level premiums, which are fixed until then.

A stepped policy would start cheaper (~$85/month) but exceed $300/month by her 70s.

🧠 Pro Tip:

“Choose stepped if you need cover short-term and want low initial costs. Choose level if you’re planning ahead, budgeting for retirement, or want to avoid price hikes down the road.”

📊 Not Sure Which is Right for You?

What fits your budget or life stage? Use our Compare Life Cover to see the cost difference between stepped and level premiums based on your age and goals.

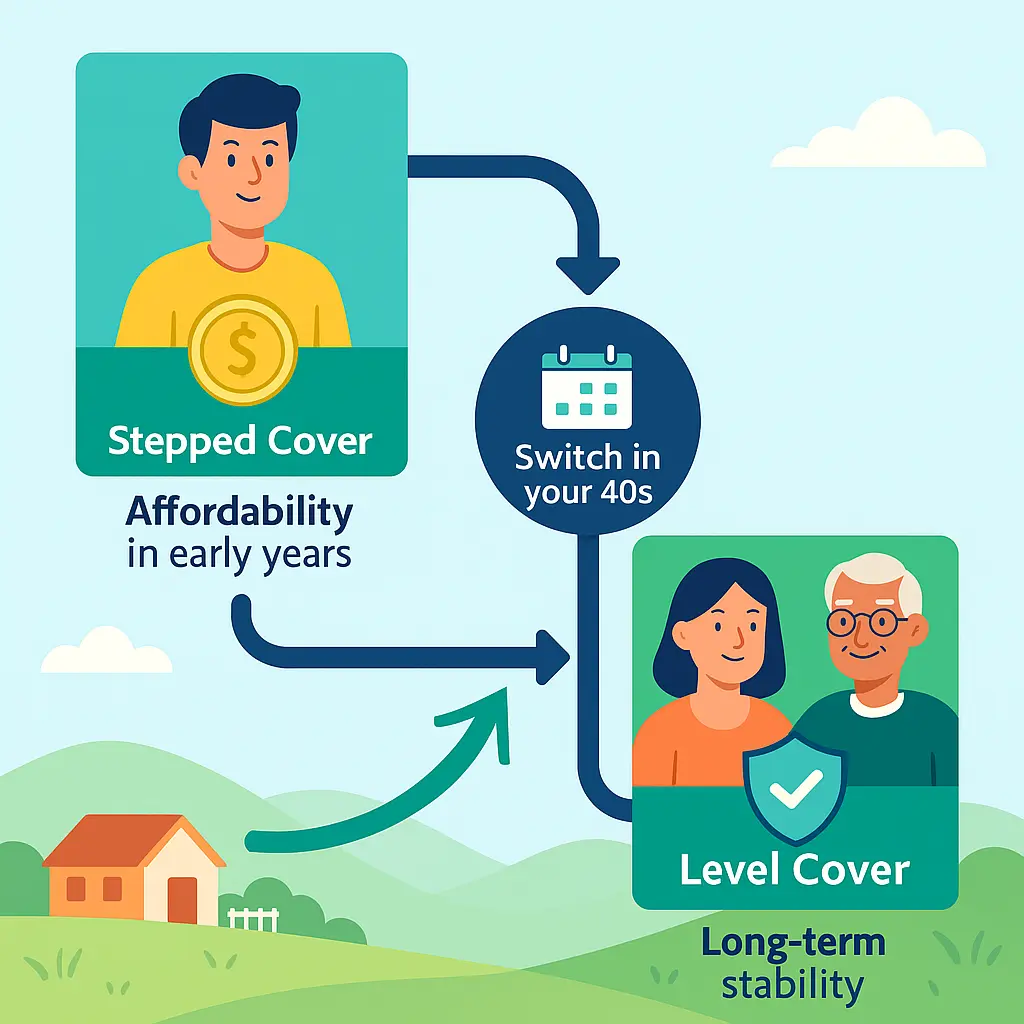

🔁 Strategic Hybrid Approach: Mix & Switch Guide

Choosing between stepped vs level life insurance premiums doesn’t have to be an either-or decision. For many New Zealanders, a hybrid strategy—starting with stepped premiums and later switching to level cover—offers the best balance of early affordability and long-term stability.

This approach is especially effective if you’re in your 20s–40s, managing a mortgage, raising kids, or planning for retirement.

🧭 What Is a Hybrid Premium Strategy?

A hybrid strategy means using stepped premiums initially, when cost is a bigger concern, and switching to level premiums later, typically within the first 5–10 years, once your income is more stable and your budget allows.

Some insurers let you split your policy—for example, $400,000 of cover on stepped premiums and $100,000 on level—allowing you to blend flexibility and predictability immediately.

🧠 Why It Works

| Stage of Life | Stepped Cover Benefits | Level Cover Benefits |

| Early career / young family | Lower cost while managing other expenses | N/A – level might feel unaffordable |

| Mid-career / growing income | Stepped still cheaper, but increasing fast | Start transitioning to the level for stability |

| Pre-retirement | Costs for stepping become steep | Level locks in fixed costs at the ideal time |

📉 Example: Hybrid Strategy in Action

Case: Ana (36), Wellington – 2 kids, mortgage, freelance income

- Current budget: tight — mortgage and school costs dominate.

- Step 1: Starts with $500K of stepped cover at $42/month.

- Step 2: After 5 years, her income grows, so she switches $300K to level premiums while keeping $200K for flexibility.

- Step 3: By age 50, she converts the remainder to level and locks in predictable premiums through retirement.

💡 Result: Ana saves over $3,000 in her early years and still avoids the steep rises of stepped premiums later on.

✅ Step-by-Step: How to Apply the Hybrid Strategy

1. Start with Stepped Cover (Affordability Phase)

- Ideal when you’re under financial pressure (e.g. first home, childcare, starting a business).

- Choose an insurer that allows future conversion to level premiums without new underwriting.

2. Set a Review Timeline

- Regularly review your financial circumstances every 3–5 years.

- Consider life events (e.g. new child, higher income, reduced debt) when planning your next steps.

3. Switch to Level Cover (Stability Phase)

- Switching to level premiums once your income stabilises or your major debts (like a mortgage) start shrinking.

- Lock in your premiums while still in good health to get favourable rates for the rest of the policy term.

4. Lock in Long-Term Savings

- Switching by age 40–45 often gives you the best shot at affordable, level premiums with fixed costs through retirement.

Key Considerations Before You Switch

- Conversion timeframes matter: most insurers allow switching from stepped to level within 3–5 years without a health reassessment.

- Underwriting may apply later: Level premiums could be more expensive if your health changes before switching.

- Start planning early: Waiting too long means missing the crossover window for savings.

📊 At-a-Glance: Should You Switch?

| Scenario | Recommended Strategy |

| Under 35, new mortgage, tight budget | Start with stepped, review in 5 years |

| Late 30s–early 40s, rising income | Switch part to level now |

| Over 45, nearing retirement | Lock in full level premiums |

| Freelancers/business owners | Blend stepped and level for flexibility |

💬 Pro Tip:

“If you’re healthy and under 40, you may be able to lock in level premiums now—even on part of your policy. That future you who’s paying $300/month in stepped premiums will thank you!”

🛠 Use Our Compare Tool to Find the Best Deal

Run your “Mix & Switch” strategy using our NZ Life Insurance Comparison Tool.

Compare stepped, level, or blended cover options from top NZ insurers — and see which offers the best value for your budget and long-term goals.

Health Insurance: A Different Model

While stepped vs level life insurance premiums are common structures for life insurance in New Zealand, it’s important to note that health insurance operates differently. Health insurance premiums aren’t structured as stepped or level, unlike life policies. Instead, they typically increase based on factors like rising healthcare costs, your age group, claims history, and provider-specific policy changes.

Managing your health insurance premiums usually involves adjusting your policy’s excess or changing coverage limits, rather than choosing a stepped or level model. For instance, increasing your excess—the amount you pay upfront if you make a claim—can lower your premium, offering some budget flexibility.

🧠 It’s important to review your health insurance regularly to make sure it still suits your needs.

👉 Compare health plans at CompareMedicalInsurance.co.nz

👉 Learn more at the Ministry of Health NZ

💸 Cost Drivers: What Pushes Your Premiums Up?

Life insurance isn’t just about what you pay today—it’s about how your premiums behave over time. For Kiwis choosing between stepped and level cover, understanding the key cost drivers is critical for long-term budgeting.

While many people expect stepped premiums to increase, they’re often surprised by how fast costs escalate, especially when other factors are layered in.

📈 The 3 Biggest Premium Drivers in NZ

1. CPI-Linked Increases (Inflation Adjustments)

Many policies offer optional or automatic CPI (Consumer Price Index) increases. These help your coverage keep pace with inflation, but they also raise your premium yearly.

- Typically ranges from 2% to 5% annually.

- Stepped cover: CPI is added on top of your age-based increase

- Level cover: Cover increases, but premiums may remain fixed depending on your insurer

🧠 Pro Tip: Inflation protection makes sense for long-term policies—but only if you can afford the compounding increases later in life.

2. Policy Administration & Flat Fees

Most insurers charge a base policy fee—often around $5 to $10/month—on top of your actual premium.

Over 20–30 years, these fees can add up to thousands, especially if CPI indexing is applied to the full premium (including fees).

3. Insurer Pricing Reviews & Risk Pool Adjustments

Insurers in New Zealand periodically review their entire customer base (or “risk pool”) and may adjust premiums across the board, even for level cover.

- This is more likely for older policies or when external economic pressures increase claim costs.

- Insurers may raise premiums mid-term for newer policies with flexible pricing clauses.

How It All Adds Up: Example Modelling

Let’s take a 35-year-old non-smoker with a $500,000 policy and see how cost increases play out:

| Age | Stepped Premium | Stepped w/ CPI (3%) | Level Premium | Level w/ CPI (3%) |

| 35 | $400/year | $412/year | $800/year | $800/year |

| 45 | $540 | $726 | $800 | $1,074 |

| 55 | $720 | $1,060 | $800 | $1,390 |

| 65 | $970 | $1,520 | $800 | $1,800 |

🧠 Key Takeaways

- Stepped premiums increase not just from age, but from inflation and fees

- Level premiums may feel expensive now, but often save you $5,000–$10,000+ over 20–30 years.

- If your budget can handle it, locking in fixed costs early gives you better control long-term

🔧 Want to Forecast Your Own Premiums?

Use our Life Insurance Calculator to model your expected premium costs across stepped, level, and hybrid options. Run CPI projections, see your crossover point, and compare total spend over time.

Or jump straight to Compare Life Insurance Quotes to see what today’s top NZ insurers will charge based on your age, smoking status, and health.

💰 Cost Comparison: Stepped vs Level Life Insurance Premiums Over Time

When choosing life insurance, price today isn’t the whole story. The real difference between stepped and level premiums appears over time. Here’s how much you could pay for a $500,000 life policy as a healthy, non-smoking 35-year-old in New Zealand.

We’ve modelled 3 scenarios across 30 years:

- Stepped Premiums (no inflation)

- Stepped Premiums + 3% CPI adjustment

- Level Premiums (fixed)

📊 Premium Projection Table – Annual Cost Over Time

| Age | Stepped Premium | Stepped + CPI | Level Premium (Fixed) |

| 35 | $400 | $412 | $800 |

| 40 | $510 | $592 | $800 |

| 45 | $650 | $730 | $800 |

| 50 | $800 | $950 | $800 |

| 55 | $970 | $1,200 | $800 |

| 60 | $1,150 | $1,490 | $800 |

| 65 | $1,350 | $1,820 | $800 |

🧾 Total Cost Over 30 Years

| Policy Type | Total Premium Paid |

| Stepped Only | NZ$26,340 |

| Stepped + CPI (3%) | NZ$33,800+ |

| Level Only | NZ$24,000 |

🔄 The Crossover Point

Around years 13–15, the stepped premium catches up and exceeds the level premium in annual cost. From that point on, level premiums start saving you money yearly.

🔍 Key Observations

- Stepped starts are cheap but increase quickly as you age, especially after age 50.

- Stepped + CPI rises even faster due to inflation compounding on top of age-based hikes.

- Level premiums stay the same yearly, making long-term budgeting much easier.

- The crossover point usually hits between years 13–15, where stepped premiums become more expensive than level.

- If you keep your coverage past age 50, level premiums are almost always cheaper.

📦 Recommendation Box

💡 Quick Take:

If you plan to keep your policy for over 10 years, level premiums are usually more cost-effective. They give you stability, a lower lifetime cost, and fewer surprises as you age.

🛠 Ready to Run Your Numbers?

Use our NZ Life Insurance Calculator to simulate stepped vs level premiums based on your age, health, and cover amount.

Want to see what real insurers will charge you today?

Compare life insurance quotes and explore your personalised options in minutes.

Retirement Planning Deep-Dive

When planning for retirement, it is crucial to consider how your family will handle expenses after you’re gone. Even with diligent savings, unforeseen end-of-life costs can quickly erode your family’s financial security.

Cover Yours Insurance highlights key costs Kiwi families typically face:

1. Funeral Expenses (~NZ$10,000)

On average, funerals in New Zealand cost around NZ$10,000. This covers funeral director fees, caskets, service costs, burial or cremation fees, and catering. Without adequate preparation, these expenses can strain family finances significantly.

2. Legal Fees & Estate Administration (NZ$3,000–NZ$8,000)

Settling an estate often involves legal and probate fees, especially if complexities arise, such as disputes over a will or managing trusts. These expenses, typically between NZ$3,000 and NZ$8,000, must be factored into your financial planning.

3. Family Travel and Accommodation (NZ$1,000–NZ$5,000)

Relatives often need to travel for memorial services, funerals, or to settle estate matters. This cost increases significantly if family members reside overseas or in distant parts of New Zealand.

4. Late-life Medical Bills (Variable)

Medical costs in the final years of life—like hospital care, specialist visits, or home-based support—can rapidly accumulate, often placing unexpected pressure on family resources.

Why Locking in Level Cover Into Retirement Matters

Level life insurance becomes particularly valuable as you approach retirement because your premiums remain fixed, shielding you against rising costs. Locking in level cover:

- Protects your pension fund: With predictable premiums, your pension savings won’t be unexpectedly drained by rising insurance costs.

- Secures your family’s financial stability: Knowing that fixed, manageable premiums are in place helps ensure your family isn’t left vulnerable to high expenses when you’re gone.

- Offers peace of mind: a predictable, stable policy lets you confidently plan your retirement, ensuring your financial legacy is well-protected.

Planning ahead means your loved ones aren’t burdened financially, allowing them to focus on what truly matters during challenging times.

👵 Real-Life Example:

Brian (60), Hamilton – Mortgage-Free, 2 Adult Children

Brian wants his funeral and legal costs sorted in advance. He locks in a $250,000 level policy to age 80, paying $180/month.

If he had chosen stepped cover, his premiums would have started around $140/month, but reached over $400/month by his mid-70s.

By sticking with the level, he:

- Protects his KiwiSaver balance

- Gives his family breathing room

- Avoids policy cancellation due to affordability

📉 Use Level Cover to Pre-Fund Your Legacy

Think of life insurance as a tax-free lump sum you’re setting aside for your family. It can help with:

- Funeral and burial costs

- Helping whānau take time off work

- Covering unpaid bills and debts

- Protecting an inheritance or gifting funds

🛠 Model Your Retirement Cover Now

Use our Life Insurance Calculator to compare how stepped vs level cover impacts your retirement budget.

Or compare life insurance quotes to see how much coverage you can lock in today.

⚠️ Cancellation Risks & Long-Term Affordability

One of the most overlooked realities of life insurance is that many people cancel their policy before ever making a claim—especially with stepped cover. Why? because the cost becomes too high to maintain as they age.

According to industry insights from SIA Insurance Advisory, around 85% of stepped policies in New Zealand are cancelled before a claim is ever made. That means thousands of Kiwis pay premiums for years, only to lose their protection when needed.

📉 Why This Happens

🧨 1. Stepped Premiums Escalate Fast

- A stepped premium that costs $30/month at age 35 could rise to $300/month or more by age 65.

- Add CPI adjustments, and the jump can be even steeper.

💸 2. Retirement = Reduced Income

- In your 60s or 70s, fixed incomes or reliance on KiwiSaver make large premiums unaffordable.

- Many cancel just as their risk of passing away increases — the worst timing possible.

🔄 3. No Refunds on Cancellation

- Life insurance is use-it-or-lose-it — cancel the policy, and all your paid premiums are gone.

- Restarting coverage later may require full medical underwriting and much higher premiums.

🔢 Real Cost Snapshot (Age 35–65, $500K Cover)

| Age | Stepped Premium | Level Premium |

| 35 | $30/month | $67/month |

| 45 | $55 | $67 |

| 55 | $120 | $67 |

| 65 | $250–300+ | $67 |

🧠 Observation:

At age 65, when you’re most likely to make a claim, you’ll pay 4–5 times more with stepped cover than level.

🔁 The Tipping Point

“Stepped premiums are often abandoned just when they’re finally most valuable—because people can’t afford to keep them going.”

👨⚖️ Case Example:

Jeremy (58), Wellington – Still Working, Wants to Retire at 65

Jeremy had a stepped policy for 20 years. At first, it was only $35/month.

But at 58, he’s now paying $210/month — and by age 65, it’ll be nearly $300.

He realises too late that switching to level cover at 45 would’ve saved him over $6,000 and kept his premiums fixed through retirement.

✅ How to Avoid This

- Switch to level cover in your 30s or early 40s, if possible

- Use our calculator to forecast your long-term costs.

- Set reminders to review your premiums every 3–5 years.

- Downsize your cover amount (e.g. from $500K to $250K) before cancelling outright.

See which insurers offer flexible switching or mixed cover options.

Level-Term Limitations & Reversions

While level life insurance policies offer attractive stability and predictability, they must be aware of their limitations. Many level-term life insurance policies in New Zealand have a specific age limit—typically 65 or 80—after which the premiums revert to the stepped, rate-for-age structure.

Why is this significant?

- End-of-Term Premium Spike: When your policy term ends, your previously fixed premium can suddenly jump significantly, potentially making continued coverage unaffordable at an older, riskier age.

- Reduced Coverage at Critical Times: As you approach the later years, these reversion clauses mean that your financial security could be compromised when your vulnerability and coverage needs are highest.

- Limited Options Later in Life: After the level term ends, obtaining new insurance, switching policies at an advanced age, or declining health can be challenging and expensive.

To avoid surprises, carefully review the fine print of your policy to understand clearly when your premiums end and what happens afterwards. This ensures you’re fully prepared and financially secure when it matters most.

Does your policy have hidden term limitations?

Speak to a Kiwi Insurance Adviser.

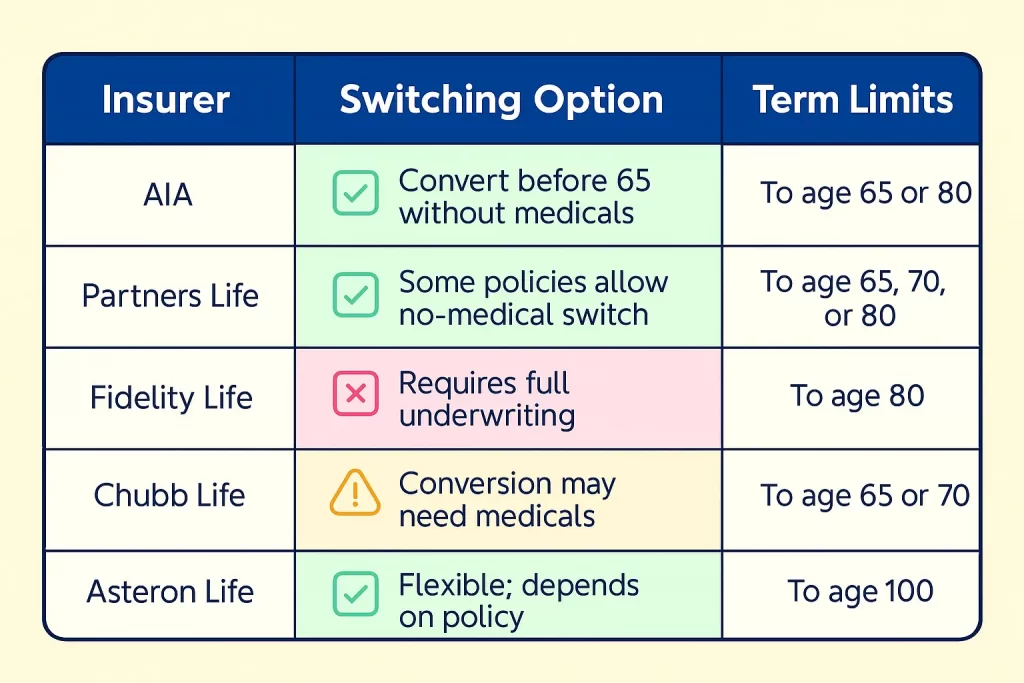

🧾 Insurer-Specific Conditions & Fine Print

Not all life insurance policies are created equal, especially regarding premium guarantees, cover limits, and policy terms. Even if two insurers offer “level premiums, ” the experience can differ drastically.

That’s why it’s crucial to read the fine print and understand how each provider handles renewals, conversions, and policy reviews.

🧐 What to Watch For in the Fine Print

1. Premium Guarantee Periods

Some level premiums are fixed until a set age (e.g. 65, 70, or 80). After that, they may:

- Revert to stepped premiums

- Require policy renewal at a new (higher) rate.

- Become unaffordable due to sudden spikes.

2. Mid-Term Health Underwriting

In some policies, especially those with flexible benefits, the insurer may reserve the right to:

- Reassess your health during significant policy changes

- Re-rate your premium if you increase cover.

- Require updated medical information if you renew post-term

3. Maximum Cover Limits

Insurers may cap how much cover you can hold on level premiums, especially if you apply later in life.

📊 NZ Insurer Snapshot: How They Differ

🔍 Key Takeaways:

- AIA allows conversion to level premiums before age 65 without additional medical underwriting, with level premiums available up to age 65 or 80.

- Partners Life offers flexibility in switching to level premiums without medical underwriting on some policies, with term limits up to age 80.

- Fidelity Life requires full underwriting to switch to level premiums, with level premiums available up to age 80.

- Chubb Life provides conversion options, though medical underwriting may be necessary depending on the situation, with level premiums up to age 70.

- Asteron Life offers flexible premium structures and allows level premiums up to age 100.

✅ Recommendations:

- Verify Policy Details: Always check your policy’s specific terms and conditions, as options can vary based on the product and when it was issued.

- Consult with Advisers: Speak with a financial adviser or insurance specialist to understand the best options for your circumstances. Check comparelifecover.co.nz for more details.

- Regular Reviews: Review your policy regularly to ensure it continues to meet your needs, especially as you approach key age milestones.

Real-Life Case Studies

Let’s examine how real Kiwi families benefit from strategically using stepped vs. level life insurance premiums. These scenarios, based on typical situations faced by New Zealanders, illustrate how careful planning can save money and provide essential peace of mind.

Example 1: Young Family Mixing Stepped & Level Cover

Meet James and Emma:

James (32) and Emma (30) recently purchased their first home in Wellington and have a young daughter, Mia (2). With a mortgage of NZ$600,000, their primary concern is affordable cover to protect their family during the early stages when money is tighter.

Their Insurance Strategy:

- Initially, they chose stepped premiums for NZ$400,000 cover, aligning affordability with their tight budget.

- They locked in an additional NZ$200,000 level-term policy to cover long-term costs like funeral expenses and final bills.

Outcome:

- Lower stepped premiums initially allowed James and Emma to comfortably manage their cash flow.

- By mixing stepped and level cover, they protected against future premium hikes on part of their insurance, giving long-term financial stability.

Example 2: Pre-Retiree Switching to Level for Retirement Stability

Meet Margaret:

Margaret (55), from Christchurch, had a stepped-premium life insurance policy for many years. Approaching retirement, she realised the increasing premiums (now over NZ$250/month) would quickly become unaffordable.

Her Insurance Strategy:

- Margaret reviewed her options and decided to switch to a level-premium policy at age 55, locking in fixed premiums to age 80.

- She set the coverage at NZ$250,000—enough to comfortably cover funeral expenses, medical costs, and estate administration fees and leave a modest inheritance for her two adult children.

Outcome:

- Switching to level premiums stabilised Margaret’s monthly budget, eliminating future surprises.

- Margaret gained peace of mind knowing her financial legacy was secure, allowing her to enjoy retirement without worry.

These real-life Kiwi scenarios highlight the practical benefits of a well-considered life insurance strategy. Want personalised insights into your situation?

📞 Before You Commit – Compare Providers Side-by-Side

Use our Life Cover Comparison Tool to review how NZ insurers stack up—by policy flexibility, age limits, and cover options.

Or talk directly to someone who can explain the fine print:

👉 Speak to a Kiwi Insurance Adviser

Frequently Asked Questions (FAQS)

1. What is the difference between stepped and level premiums?

- Stepped Premiums: These start lower but increase annually as you age. They’re suitable for short-term needs but can become expensive over time.

- Level Premiums: These remain constant throughout the policy term, making them ideal for long-term financial planning.

2. Can I switch from stepped to level premiums later?

Yes, many insurers allow switching from stepped to level premiums. However, this may require medical underwriting, and the new premium will be based on your age at the time of the switch.

3. What happens if I cancel my policy?

If you cancel your policy, you will lose the coverage and any premiums paid. It’s essential to consider the long-term implications before cancelling, especially if you’ve held the policy for many years.

4. Are there policies with premiums that remain level for life?

Some insurers offer level premiums up to a certain age, such as 65, 70, 80, or even 100. After this term, premiums may increase or the policy may convert to a different structure.

5. How does CPI indexing affect my premiums?

CPI (Consumer Price Index) indexing adjusts your sum insured to keep up with inflation. While this maintains the real value of your coverage, it also increases your premiums annually.

✅ Conclusion & Next Steps

Choosing between stepped vs level life insurance premiums isn’t just about the numbers — it’s about how you want to protect your whānau, manage your budget, and prepare for the future.

Each premium structure offers unique advantages:

🔁 Quick Recap

| Premium Type | Best For |

| Stepped | Early affordability, short-term goals (e.g. mortgage, young kids) |

| Level | Predictable budgeting, long-term savings, and retirement planning |

| Hybrid | Those starting with a lower budget but planning to switch for stability |

🎯 Your 4-Step Action Plan

- Review your financial needs and life stage

– Are you early in your career? Nearing retirement? Supporting a family?

- Compare stepped vs level options.

– Use our tools to project long-term costs and identify your premium “crossover point”.

- Check your policy terms carefully.

– Look for term limits, CPI clauses, switching conditions, and cover exclusions.

- Set a review reminder.

Reassess every 2–3 years or when major life changes occur (e.g., new child, new home).

You’ve learned the difference between stepped vs level life insurance premiums and hybrid premiums — now it’s time to see what fits your real-life goals.

👉 Compare Life Insurance Quotes – Get instant, side-by-side premium estimates from NZ’s leading insurers.

📌 Disclaimer

The information in this article is for general guidance only and does not constitute personalised financial advice. Life insurance policies vary between providers, and your individual circumstances may affect eligibility, premiums, and coverage. Always read the full policy wording and consult a licensed financial adviser before making decisions. Premium examples are indicative only and subject to change.

Latest Post

- Life Insurance for Senior Citizens in NZ: The 2025 Master Guide

- AIA’s Specialist and Testing Support – New Health Benefit Explained

- How Much Life Insurance in NZ Do Kiwis Need? 2025 Expert Guide

- Life Insurance vs Mortgage Protection in NZ: Key Differences

- Best Life Insurance Policies in NZ 2025: Expert Kiwi Guide