Life Insurance vs Mortgage Protection in NZ: Key Differences

Table of Contents

Toggle

- Life Insurance vs Mortgage Protection in NZ: Life insurance provides a lump sum to your beneficiaries on death, whereas mortgage protection is specifically designed to cover your mortgage repayments.

- Kiwis remain underinsured: Only 41% report holding life insurance, highlighting protection gaps for families with mortgages.(blog.fsc.org.nz)

- Mortgage pressure is real: Average weekly mortgage payments rose to $658.20 (up 8.7%), while mortgage interest payments jumped 35.8% in the year to June 2024 — increasing the value of policies that safeguard repayments. (Stats NZ)

- Rules tighten for risky debt: DTI limits began on 1 July 2024, capping the share of high-DTI lending; this makes affordability checks stricter and underscores the need to plan cover alongside lending. Reserve Bank of New Zealand

- Practical takeaway: Life insurance = flexible lump sum that can clear the mortgage and fund living costs; mortgage protection = targeted cover focused on keeping the house if income stops. (For current mortgage-rate context, see RBNZ B30 series)

What is Life Insurance in NZ?

Life insurance in New Zealand is designed to give families financial security when the unexpected happens. Life Insurance vs Mortgage Protection in NZ is often debated, but life insurance stands out because it pays a lump sum to your chosen beneficiaries when you pass away. This money can be used however your family sees fit — clearing the mortgage, paying off other debts, covering everyday living costs, or even funding your children’s education.

According to the Financial Services Council (FSC), only 41% of New Zealanders currently hold life cover, despite widespread mortgage debt. This underinsurance gap means many Kiwi households are vulnerable if the main income earner dies unexpectedly.

Many NZ insurers also offer add-ons such as funeral benefits, trauma cover, or total permanent disability cover, giving flexibility to tailor protection.

Case in point: A Wellington family with a $700,000 mortgage could use a $500,000 life insurance payout to partially repay the home loan, while also reserving funds for childcare and day-to-day living. Mortgage protection would only cover loan instalments, but life cover offers freedom of choice.

Ultimately, life insurance is the broader, more flexible option in the Life Insurance vs Mortgage Protection in NZ conversation, and it forms the foundation of most Kiwi families’ financial safety nets.

Ready to see how affordable flexible life cover can be for your family?

Compare NZ policies in minutes at Compare Life Cover or book a free advice call with our advisers.

What is Mortgage Protection Insurance in NZ?

When weighing Life Insurance vs Mortgage Protection in NZ, mortgage protection is more specific — it exists to keep your home loan repayments covered if you die, lose your job, or become unable to work due to illness or injury. Unlike life insurance, which pays a lump sum to your family, mortgage protection generally directs payments towards your bank or lender to ensure the mortgage stays current.

There are different types of mortgage protection policies available in New Zealand:

- Death-only cover, where the mortgage is repaid if you pass away.

- Death + redundancy cover, adding protection against job loss.

- Some policies include death, redundancy, and illness/injury cover, though availability and terms vary by insurer

According to Stats NZ, the average weekly mortgage payment is now $658.20 – up 8.7% in the year to June 2024. These rising repayments make mortgage protection increasingly relevant for households under financial pressure

In practice, policies vary by insurer — some pay the lender directly, while others pay you to manage repayments yourself. The cover is usually linked to the outstanding loan size, meaning premiums may fall as your mortgage balance reduces.

For example, a family in Christchurch with a $550,000 mortgage may find reassurance in knowing that, if the primary income earner is made redundant, their insurance steps in to meet repayments until new work is found.

In short, mortgage protection is narrower and targeted: it’s about keeping the roof over your head, while life insurance offers broader financial flexibility.

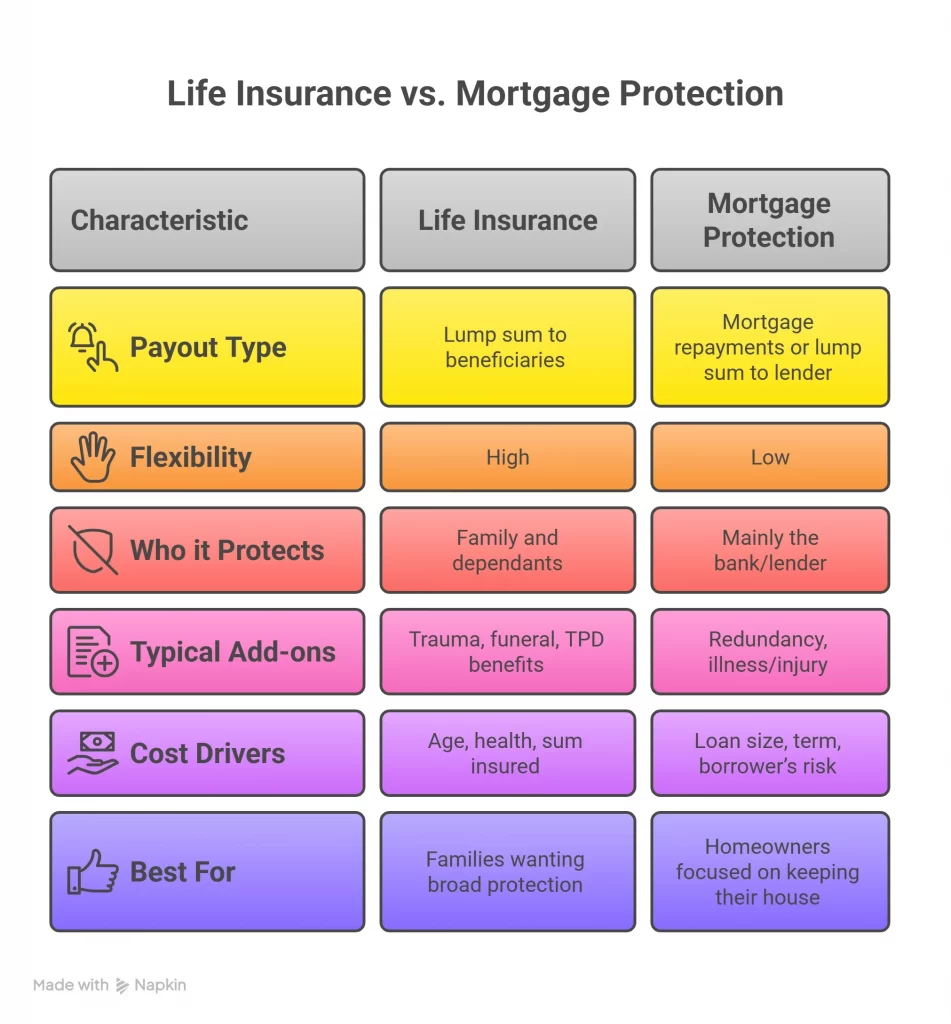

Key Differences: Life Insurance vs Mortgage Protection in NZ

The question of Life Insurance vs Mortgage Protection in NZ comes down to flexibility versus focus. While both provide peace of mind, they operate in very different ways.

At its core:

- Life insurance pays a lump sum to your family, giving them the freedom to choose how the money is spent.

- Mortgage protection insurance pays ongoing mortgage instalments or clears the home loan, ensuring the bank gets paid first.

Here’s a quick comparison:

| Feature | Life Insurance | Mortgage Protection |

| Payout type | Lump sum to beneficiaries | Mortgage repayments or lump sum to lender |

| Flexibility | High — can cover any expense | Low — restricted to mortgage |

| Who it protects | Family and dependants | Mainly the bank/lender |

| Typical add-ons | Trauma, funeral, TPD benefits | Redundancy, illness/injury |

| Cost drivers | Age, health, sum insured | Loan size, term, borrower’s risk |

| Best for | Families wanting broad protection | Homeowners focused on keeping their house |

For example:

- A Hamilton couple with two children and a $700,000 mortgage could use a $500,000 life insurance payout to cover the loan and still fund school fees and living expenses.

- With mortgage protection, that same couple would see only their repayments covered, meaning other expenses could become a struggle.

Ultimately, life insurance offers broader, more flexible protection, while mortgage protection is a targeted tool to safeguard your home. Sometimes a mix of both can make sense, but understanding the differences will help you avoid paying for duplicate cover.

Choosing between life insurance and mortgage protection?

If you’re choosing between life insurance and mortgage protection, many experts suggest starting with life cover. Life policies can even include add-ons like trauma cover for serious illnesses (for example, a $500k life policy that pays out $200k upon a major illness).

Compare real quotes now for free at Compare Life Cover.

Cost Comparison in NZ

Life Insurance vs Mortgage Protection in NZ — how much does each option cost, and what drives the price?

Life Insurance Costs

Life insurance in New Zealand is relatively competitive. A 30-year-old non-smoking male can expect to pay under $400 a year for a $500,000 life insurance policy when shopping smart.

Quashed’s March 2025 pricing gives a clearer breakdown:

- Male, 30s: $500,000 cover costs between $23–$53/month.

- Female, 30s: Same cover costs $20–$43/month.

And, according to other data:

- 30-year-old females (non-smoker): $10.75–$13.00 per fortnight (~$22–$26/month).

- 30-year-old males: $15.93–$18.51 per fortnight (~$32–$37/month).

Mortgage Protection Insurance Costs

Mortgage protection insurance quotes are similarly pegged to age, mortgage size, and coverage duration. PolicyWise offers sample fortnightly rates for covering mortgage payments of $3,500/month with a 13-week waiting period:

- 30-year-old female (non-smoker): $24–$26 fortnightly ($48–$52/month).

- 30-year-old male: $17–$21 fortnightly ($34–$42/month).

- 40-year-old female: $37–$43 fortnightly ($74–$86/month).

- 50-year-old female: $73–$80 fortnightly ($146–$160/month).

Another provides larger-scale annual cost estimates for someone with a $500,000 mortgage and $3,500/month repayments:

- 35-year-old male (Accountant): ~$335–$476/year.

- 45-year-old male (Builder): ~$913–$1,139/year.

- 40-year-old couple (Teachers): ~$1,250–$1,600/year.

- 50-year-old couple (Smokers): ~$2,727–$3,425/year.

Summary Comparison

- Life insurance (~$20–$53/month): Affordable lump-sum cover, lower for younger policyholders, gender and health dependent.

- Mortgage protection (~$35–$85/month): Designed to cover actual loan repayments — costs rise with age, mortgage size, and optional extras like redundancy cover.

Which is Better for Homeowners in NZ?

The debate around Life Insurance vs Mortgage Protection in NZ doesn’t have a one-size-fits-all answer. The best option depends on your family situation, debt level, and financial priorities.

For many homeowners, life insurance is considered the foundation of protection. It delivers a lump sum that your family can use as needed — to pay off the mortgage, cover school fees, or maintain day-to-day expenses. This flexibility is a significant reason why financial advisers often recommend life insurance as the first layer of coverage.

By contrast, mortgage protection insurance is narrower but more targeted. It ensures your mortgage repayments are made directly, so you won’t lose your home even if your income stops. This is especially relevant for households with high debt-to-income ratios. According to the Reserve Bank of New Zealand, the country’s household debt-to-income ratio is above 170%, one of the highest levels on record. This means that many Kiwi families are highly vulnerable if their income suddenly drops.

Consider these scenarios:

- A young Auckland couple with a $700,000 mortgage may benefit from mortgage protection to ensure repayments continue if one partner loses their job.

- A Wellington family with children may prefer life insurance, knowing the payout could clear the mortgage and fund other long-term costs.

- Some choose both, layering protection for extra security.

The key trade-off is flexibility versus certainty:

- Life insurance offers broader protection across all expenses.

- Mortgage protection guarantees your home loan won’t default.

Ultimately, the right choice depends on how important home ownership stability is compared with overall financial flexibility. Many advisers suggest starting with life cover, then adding mortgage protection if debt levels or risk factors make it worthwhile.

Most Kiwi families start with life insurance as their foundation.

Find the right cover based on your age, mortgage, and health. Visit Compare Life Cover Now to get started.

Can You Have Both Life Insurance and Mortgage Protection?

When weighing Life Insurance vs Mortgage Protection in NZ, many Kiwis ask whether it makes sense to hold both policies. The short answer is: yes, you can — but it’s not always necessary.

Having both types of cover can offer layered protection. For example:

- Life insurance provides a large lump sum that your family can allocate however they choose — repaying the mortgage, covering living costs, or funding future education.

- Mortgage protection ensures that loan repayments continue immediately if you die, are made redundant, or become unable to work.

This combination can give peace of mind, particularly for households with large mortgages and young dependants, where financial resilience is most critical.

However, owning both policies can also mean duplication of cover. For instance, if you have life insurance with a sum insured large enough to repay your mortgage, a separate mortgage protection policy may be redundant. That duplication means paying extra premiums without added benefit.

Industry advisers often recommend reviewing your total cover with a financial adviser or broker. By tailoring policies, you can avoid paying for overlapping benefits while still protecting both your home and your family’s future financial stability.

Alternatives to Mortgage Protection

In the conversation around Life Insurance vs Mortgage Protection in NZ, it’s also worth considering alternative policies that can sometimes provide better value or flexibility.

One option is income protection insurance, which replaces a percentage of your salary if you’re unable to work due to illness or injury. Unlike mortgage protection, which only covers your loan, income protection gives you ongoing income that can be used for rent, bills, food, and other expenses — not just the mortgage.

Another option is trauma insurance, which pays out a lump sum if you are diagnosed with a serious illness such as cancer, heart attack, or stroke. This can help fund treatment, cover time off work, or reduce debt.

Both alternatives are often recommended alongside life cover, as they provide broader protection than mortgage-only policies. You can compare plans at CompareIncomeProtection.co.nz and CompareTraumaInsurance.co.nz.

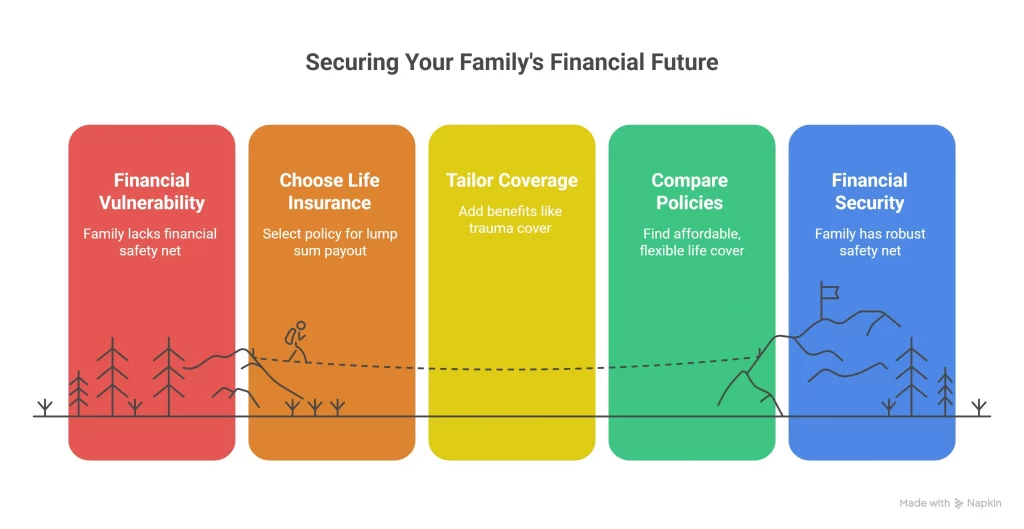

How to Choose the Right Policy in NZ

Choosing between Life Insurance vs Mortgage Protection in NZ comes down to understanding your personal financial situation and long-term goals. The right cover should balance affordability with the level of protection your family truly needs.

Here are four practical steps for Kiwi homeowners:

- Assess your household needs – Consider your dependents, income sources, and debts. If your family struggles to cover living costs beyond the mortgage, life insurance may provide broader protection.

- Review your mortgage size and term – If you have a large home loan relative to your income, mortgage protection can provide certainty that repayments will always be met.

- Compare policies and premiums – Use trusted NZ comparison tools like Compare Life Cover for life insurance and Compare Mortgage Insurance for mortgage protection to quickly see your best options.

- Seek independent advice – Licensed financial advisers can help tailor cover to your needs, ensuring you don’t overpay for overlapping benefits.

Finally, revisit your policy regularly. As your mortgage reduces or your family’s circumstances change, the right level of cover may shift over time.

FAQs: Life Insurance vs Mortgage Protection in NZ

1. What is the difference between life insurance and mortgage protection in NZ?

Life insurance vs mortgage protection in NZ comes down to flexibility versus focus. Life insurance pays a lump sum to your family, which they can use for any expense they may incur. Mortgage protection specifically covers your mortgage repayments, often paying directly to the lender.

2. How much does mortgage protection cost compared to life insurance in NZ?

Mortgage protection costs usually scale with your loan size, age, and risk factors. Trusted data shows that the average coverage for a 30-year-old is $35–$50 per month, while life insurance for the same person typically costs $20–$40 per month for a $500,000 coverage.

3. Do I need life insurance if I already have mortgage protection in NZ?

Yes, often you do. Mortgage protection only ensures your house is paid for. Life insurance provides funds for other essential expenses, such as childcare, groceries, and education.

4. Can I get both life insurance and mortgage protection in NZ?

Yes. Many Kiwis choose both, layering cover for greater certainty. However, you should review your policies carefully to avoid paying for duplicate benefits.

5. Which is better for homeowners in NZ: life insurance or mortgage protection?

It depends. Life insurance is broader and more flexible, while mortgage protection gives certainty that your loan will be covered. The best option depends on your family’s needs, the size of your mortgage, and your budget.

Conclusion: Making the Right Choice

The debate over Life Insurance vs Mortgage Protection in NZ boils down to what you value most: flexibility or certainty. Life insurance provides a lump sum that your family can spend however they need — clearing the mortgage, covering daily expenses, or securing future education. Mortgage protection is narrower but ensures your home loan is always covered, giving homeowners peace of mind during tough times.

In today’s climate of rising mortgage costs and high household debt-to-income ratios, both types of cover can play a role in protecting Kiwi families. However, it’s important to avoid duplication and pay only for what your household genuinely needs.

For many, life insurance forms the foundation of financial security, while mortgage protection is a useful add-on for those carrying large home loans. The right balance depends on your mortgage size, family commitments, and income stability.

🔎 Ready to make an informed choice?

- Compare life insurance now at Compare Life Cover — it’s fast, free

Secure your family’s future and your home today — Compare cover now and get peace of mind.

Latest Post

- Life Insurance for Senior Citizens in NZ: The 2025 Master Guide

- AIA’s Specialist and Testing Support – New Health Benefit Explained

- How Much Life Insurance in NZ Do Kiwis Need? 2025 Expert Guide

- Life Insurance vs Mortgage Protection in NZ: Key Differences

- Best Life Insurance Policies in NZ 2025: Expert Kiwi Guide