What Factors Determine Life Insurance Cost?

As you begin the journey of finding the best life insurance coverage for your situation, cost is going to be one of the biggest factors that you consider. You may be wondering how insurers determine premium costs for these policies and how this applies to you. Today, we are going to discuss how policy costs are determined and what this means for you.

All life insurance company will require those who are looking to set up a policy to answer health questions and sometimes undergo a physical exam before issuing a policy. This is because your insurance rate will typically be based on your health and age. They may look at other factors such a nicotine and alcohol usage, weight, and family medical history as well. By understanding what factors determine policy costs, you can choose the best and most affordable option for yourself and your family.

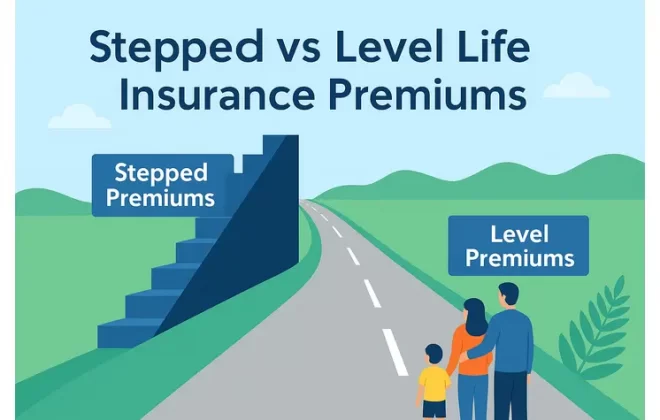

In New Zealand, insurers typically charge higher premiums for men vs. women. Age is also a factor, with policy premiums rising as your age rises. For this reason, it can make good financial sense to look for life insurance with a Level Premium option. This type of life insurance will have a high premium for cover at first, but will eventually break even with age-rated premiums. This means it will be lower cost, in the long run, giving you coverage you can afford later in life.

As previously mentioned, health is a huge determining factor in how much you will pay for life insurance. Once you have chosen a policy and it gets to the underwriting process, you may be asked to provide family history, have a physical, or get bloodwork at the expense of the insurance company. Some may even ask for a Personal Medical Attendance Report (PMAR) from your practitioner.

Pre-existing conditions such as chronic illness or past cancer diagnosis may lead a life insurance company to consider you to be at high risk of premature death. They also tend to look at your Body Mass Index (BMI). Those who are obese may also be given a poor health analysis. These aforementioned factors will lead to higher insurance costs, as you are at a greater risk of dying than someone who is considered in excellent health.

To get the best rate on life insurance, you should try to live the healthiest lifestyle possible. Let the insurance experts at Compare work to match you with the best life insurance policy for you and your lifestyle.

Important: All information on this site is of a general nature only. When you compare or complete the assessment online, we will connect you with an advisor who can give you advice at no charge. All advisers who are authorised to use this site, for their marketing purposes, are authorised financial advisers. A full list of advisers and what they can advise on is listed here under our terms & conditions of this site usage.

Latest Post

- Life Insurance for Senior Citizens in NZ: The 2025 Master Guide

- AIA’s Specialist and Testing Support – New Health Benefit Explained

- How Much Life Insurance in NZ Do Kiwis Need? 2025 Expert Guide

- Life Insurance vs Mortgage Protection in NZ: Key Differences

- Best Life Insurance Policies in NZ 2025: Expert Kiwi Guide