Life Insurance for Self-Employed Kiwis

Table of Contents

While self-employment offers freedom and flexibility, it also comes with financial risks. Unlike salaried employees, self-employed don’t have employer-sponsored benefits, meaning no paid sick leave, life insurance, or guaranteed income if something goes wrong.

That’s why Life Insurance for Self-Employed Kiwis is essential. It acts as a safety net, ensuring your income, business, and family remain financially secure if you get sick, are injured or pass away.

📌 Want to compare policies now? Get a free life insurance quote in minutes with Compare Life Cover and find the best policy for your needs!

Why Life Insurance Is Crucial for Self-Employed Kiwis

When you’re self-employed, you are the system. There’s no HR department covering your back. Self-employed New Zealanders enjoy flexibility and independence, but these perks also have unique risks. If you’re sick, injured, or pass away, your income stops—and so does everything it supports.

You don’t have employer-provided safety nets; one unexpected event could derail everything you’ve built.

Here are five reasons life insurance isn’t optional for the self-employed—it’s essential.

1️⃣ You Don’t Get Employer Benefits

Salaried workers get perks:

✅ Group life insurance

✅ Sick leave

✅ Income protection plans

You? You get none of that.

If you’re self-employed, YOU are the HR department.

That means every protection—life, trauma, income—is your responsibility. No one’s got your back but you.

💬 “I thought ACC would cover me. But it only handled accidents—not my illness. I wish I had set up my own protection earlier.” — Kate, self-employed artist from Dunedin

🛠 What to do: Set up your life cover or income protection policy to replace an employer’s standard offer. Compare Life Cover can help you to identify the best insurance providers.

2️⃣ The Harsh Reality of No Coverage

Meet Tom, a 42-year-old freelance photographer in Auckland. He’s built a successful business, working with top brands and enjoying financial freedom.

Then, life happens.

🚑 A car accident leaves Tom unable to work for months.

💰 No income means mortgage payments and business expenses pile up.

🏡 His family faces losing their home while he recovers.

Tom assumed he’d “figure it out“, but without a Life Insurance Policy, his business, income, and family’s financial security were all at risk.

Don’t let this be your story. Without insurance, Tom quickly drained his savings. His story clearly illustrates why self-employed Kiwis urgently need adequate coverage. The right insurance policy can mean the difference between stability and financial disaster.

3️⃣ Your Family Still Has Bills to Pay

Mortgage. Groceries. Childcare. School fees.

These don’t stop if you’re in hospital—or worse.

If you pass away unexpectedly, will your family be okay financially?

That’s what Life Cover Insurance is for:

👉 A tax-free lump sum to help your loved ones stay afloat.

They can use it to:

✔️ Pay the mortgage

✔️ Cover debts

✔️ Fund education

✔️ Keep the lights on

📊 In New Zealand, the average household needs $1,500–$2,000/month to cover essentials like rent, groceries, and power. Without income, that pressure can become overwhelming.

💡 Smart move: Combine with trauma cover for extra peace of mind.

4️⃣Your Business Debt Becomes Your Family’s Problem

Self-employed people often borrow to grow. But what happens to that debt if you’re not around?

- ❌ Outstanding loans don’t disappear. Banks and lenders will still require repayment, potentially forcing your loved ones to face significant financial pressures.

- ❌ Your family may need to sell personal or business assets. This can happen quickly and at unfavourable prices to pay off debts, dramatically reducing your family’s future financial security.

- ❌ Your business might shut down overnight. Without clear succession or financial arrangements, operations can abruptly stop, damaging your legacy and impacting your employees’ livelihoods.

✅ How Life Cover Insurance Helps:

- ✔️ Clears Outstanding Loans: Your insurance policy provides immediate funds to settle business-related debts, preventing financial burdens from landing on your family’s shoulders.

- ✔️ Enables a Smooth Business Transition: Funds from the insurance payout can enable business partners or key employees to buy out your share, securing your family’s financial position and allowing your business to continue seamlessly.

- ✔️ Keeps Operations Running Smoothly: Your employees and clients enjoy stability, preventing reputational damage or loss of business continuity.

💬 Real-Life Example :

Michael, a Christchurch Electrician:

Michael had $150,000 in business loans when he passed unexpectedly. Thankfully, his life insurance quickly cleared these debts, enabling his apprentice to buy out the business from Michael’s family at a fair price. This protected his family financially and kept the business operating smoothly.

Pro Tips:

- Regularly Review Business Debts: Keep updated records to maintain adequate insurance coverage.

- Use Buy-Sell Agreements: Partner with co-owners to ensure clear, insured ownership transitions.

- Adjust Insurance with Business Changes: Review and update coverage after taking on new debt or major investments.

5️⃣ ACC and Public Health Can’t Cover Everything

ACC only covers injuries. So if you get cancer, have a stroke, or get hit with a serious illness… ACC says, “not our problem.”

And public health? It’s great—but it’s slow.

If you become seriously ill from non-accidental causes—such as cancer, stroke, diabetes complications, or heart disease—ACC won’t provide financial support, leaving you to fend for yourself.

Additionally, New Zealand’s public healthcare system, though high-quality, has significant limitations:

- ❌ Long waitlists – Delays for non-urgent surgery and specialist treatment.

- ❌ Limited treatment options – Restrictions on medications not funded by Pharmac.

- ❌ Significant income loss – Months of waiting could leave you without earnings, rapidly draining your savings.

Private medical Insurance and trauma insurance give you faster access to care and a lump sum to handle costs, whether travel, medication, or hiring help at home or in your business.

✔️ Immediate Private Care – Receive quicker diagnoses, specialist consultations, and timely treatment without public hospital delays.

✔️ Financial Flexibility – Receive a lump sum payout upon serious illness diagnosis, helping cover your living costs, medical bills, travel, or home assistance.

✔️ Access to Non-Pharmac Medications – Gain access to critical medications or treatments not publicly funded, significantly improving your recovery chances.

📊 In 2023, the average wait time for non-urgent surgeries in NZ public hospitals exceeded 4 months. For self-employed professionals, that’s a potential 4+ months of no income.

What Type of Insurance Do Self-Employed Kiwis Need?

When you’re self-employed, the right Life Insurance Policy isn’t just about death benefits—it’s about keeping your business and income running, even when life throws curveballs.

Here are the essential types of coverage every self-employed new Zealander should consider:

1️⃣ Life Cover Insurance – Protecting Your Loved Ones

Life Cover Insurance provides a lump sum payout to your family if you pass away, ensuring they can maintain financial stability without struggling with debts and daily expenses.

What It Covers:

✔️ Funeral expenses and legal costs

✔️ Mortgage repayments and personal debts

✔️ Financial support for dependents

✔️ Business loan repayments

Best For:

Self-employed professionals, freelancers, and business owners who want to secure their family’s future.

2️⃣ Income Protection Insurance – Replacing Lost Earnings

Income Protection Insurance pays a monthly benefit (up to 75% of your income) if you can’t work due to illness or injury.

What It Covers:

✔️ Replaces lost income when you can’t work

✔️ Covers rent/mortgage, bills, and daily expenses

✔️ Helps you recover without financial pressure

Best For:

Freelancers, consultants, and contractors who rely on active income to pay the bills.

3️⃣ Trauma Insurance – A Safety Net for Critical Illness

Trauma Insurance provides a lump sum payout if you’re diagnosed with a critical illness like cancer, stroke, or heart attack.

What It Covers:

✔️ Pays for non-Pharmac-funded medical treatments

✔️ Covers rehabilitation and recovery expenses

✔️ Helps pay for daily living costs

🔗 Compare Trauma Insurance for more details.

4️⃣ Mortgage Protection Insurance – Keeping Your Home Safe

Mortgage Protection Insurance is designed to cover your home loan payments if you become unable to work due to illness or injury or in some cases, if you pass away. This policy protects your most valuable asset—your home—and ensures your family doesn’t face foreclosure during a crisis.

What It Covers:

✔️ Monthly mortgage payments if you’re temporarily disabled or critically ill

✔️ Lump sum repayment if you pass away, depending on policy

✔️ Support during extended illness when income protection may not be enough

✔️ Optional add-ons may include redundancy cover or serious illness top-ups

Best For:

Self-employed homeowners and anyone with large debts tied to their home.

🔗 Click to learn more about Compare Mortgage Insurance

Key Person vs. Self-Employed Life Insurance

Definitions:

- Key Person Insurance: This covers the loss of a crucial employee or business partner. The business itself is the beneficiary.

- Self-employed life Insurance protects the insured’s family and personal finances. Beneficiaries are usually individual or family members.

| Feature | Key Person Insurance | Self-Employed Life Insurance |

| Coverage | Protects critical business employees | Protects individual and family finances |

| Beneficiary | Business | Family |

| Tax Deductible? | ✅ Generally deductible | ❌ Usually not deductible |

| Main Purpose | Ensure business continuity | Secure personal and family finances |

Common Insurance Myths Debunked

- Myth: “ACC covers everything.”

Truth: ACC only covers accidental injuries. - Myth: “I’m young; insurance can wait.”

Truth: Illness and accidents happen at any age. Early coverage means lower premiums. - Myth: “Insurance is too costly.”

Truth: Policies can start at $30/month, which is affordable for robust protection.

To learn more, check out the life insurance myths in New Zealand.

📈 Tax Implications for Life Insurance

| Insurance Type | Tax Deductible? | Reason |

| Life Cover | ❌ No | Considered personal protection |

| Income Protection | ✅ Usually Yes | Often deductible as business expense |

| Trauma Insurance | ❌ No | Lump sums are not tax deductible |

| Mortgage Protection | ❌ Typically No | Usually personal, not business-related |

🧩 How to Choose the Right Life Insurance Policy

Choosing life insurance as a self-employed person isn’t just about ticking a box—it’s about future-proofing your lifestyle, family, and business.

✔️ Assess Your Needs – Calculate debts, expenses, and future financial goals.

✔️ Compare Life Insurance Policies – Look at different providers and coverage options.

✔️ Consider Life Insurance Premiums – Choose a policy that fits your budget.

✔️ Check Life Insurance Exclusions – Look out for restrictions on pre-existing conditions.

📌 Use our Life Insurance Calculator to find your perfect coverage.

💡 Takeaway:

Most self-employed Kiwis underestimate their worth—not just in income but in impact. Your financial footprint supports more than just your bank balance.

💲 Life Insurance Premiums for Self-Employed

| Provider | Monthly Premium | Coverage | Inclusions |

| Provider A | $30 | $500,000 | Basic cover only |

| Provider B | $38 | $500,000 | Includes trauma |

| Provider C | $34 | $500,000 | Terminal illness |

*For a 35-year-old non-smoker. Prices may vary.

Common Mistakes to Avoid When Buying Life Insurance (Especially If You’re Self-Employed)

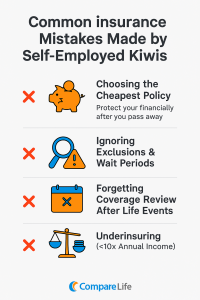

🚫 1. Choosing the Cheapest Policy Without Comparing Benefits

It’s tempting to pick the lowest premium, especially when managing irregular income—but price isn’t everything.

Why It Matters:

Cheap policies often provide limited coverage, strict exclusions, or lower payout amounts, which might not adequately protect your family or business when needed.

Example:

You pick a $20/month policy because it’s “affordable,” but it only pays out $100,000—barely enough to cover your mortgage, funeral costs, or income replacement.

✅ Fix:

Always compare value, not just cost. Use Compare Life Cover to stack providers side-by-side based on features, flexibility, and payout reliability.

🚫 2. Forgetting to Check Exclusions and Waiting Periods

Every policy has fine print. You may be surprised if you don’t read it.

What to Watch For:

- Pre-existing conditions that aren’t covered

- Dangerous activities like motorbike racing or overseas travel

- Waiting periods before certain benefits activate (especially income protection)

Example:

You file a claim after being diagnosed with a heart condition—only to learn it’s excluded because it was previously undeclared or falls within a 12-month waiting period.

✅ Fix:

Before you sign, ask the provider to explain all exclusions and waiting periods in plain English. Better yet, talk to an advisor.

🚫 3. Failing to Review Coverage After Life Events

Life changes—and so should your insurance.

Your financial responsibilities have shifted, whether you’ve just had a baby, launched a new business, or taken out a larger mortgage.

Example:

You bought life insurance when you were single and renting. Now you’ve got two kids, a house, and a business loan—but you never updated your coverage.

Result:

If anything happens to you, your existing policy may leave your family tens or hundreds of thousands of dollars short.

✅ Fix:

Set a recurring calendar reminder every 2–3 years (or after any significant life event) to review and adjust your policy accordingly.

🚫 4. Underinsuring – 10x Your Annual Income Is a Good Starting Point

Many New Zealanders pick random coverage amounts like $100,000 because “it feels like a lot.” But for most families, it’s not nearly enough.

The Reality:

- Funeral: $10,000+

- Mortgage: $300,000+

- Daily living costs: $60,000+/year

- Kids’ education, debts, medical care? Add it up.

- General Rule:

You should aim for at least 10x your annual income as a starting point. If you’re self-employed with variable income, consider your average over the past 2–3 years.

✅ Fix:

Use a life insurance calculator to accurately estimate how much your loved ones would need if you were gone.

📌 Try Compare Life Cover to get your number fast.

📌 Final Tip: Make Insurance a “Living Policy”

Your life isn’t static—your insurance shouldn’t be, either. Treat your policy like a living document:

🔁 Review every 2–3 years

🎯 Adjust when your circumstances change

📞 Talk to your advisor or insurer when life throws you a curveball

Life insurance for the self-employed isn’t just a precaution—it’s a core part of your business plan. Without it, a single illness or accident could undo years of hard work, derail your business, and leave your family financially bound.

Life insurance isn’t just smart—it’s non-negotiable.

📌 Ready to protect your income, business, and family?

Compare life insurance policies now → Compare Life Cover

🧾 FAQs: Life Insurance for Self-Employed Kiwis

Q1: Is life insurance tax-deductible for self-employed people in New Zealand?

A: Only income protection insurance is usually tax-deductible, not standard life cover.

Q2: What type of life insurance should self-employed Kiwis get?

A: Life cover and income protection are essentials—trauma and mortgage cover are great add-ons.

Q3: Can I get life insurance if I have pre-existing conditions?

A: Yes, but your policy may cost more or include exclusions.

Q4: How much life insurance cover do I need?

A: Aim for at least 10 times your annual income plus any outstanding debts.

Q5: Do I need both life insurance and income protection?

A: Yes—life cover supports your family if you pass away, while income protection helps if you’re too ill or injured to work.

Latest Post

- Life Insurance for Senior Citizens in NZ: The 2025 Master Guide

- AIA’s Specialist and Testing Support – New Health Benefit Explained

- How Much Life Insurance in NZ Do Kiwis Need? 2025 Expert Guide

- Life Insurance vs Mortgage Protection in NZ: Key Differences

- Best Life Insurance Policies in NZ 2025: Expert Kiwi Guide