Life Insurance for Senior Citizens in NZ: The 2025 Master Guide

Table of Contents

ToggleTL;DR

- Government help exists but won’t cover everything: ACC funeral grant up to $7,990.30; Work and Income Funeral Grant up to $2,616.12; Veterans’ Affairs funeral expenses $3,197.64 plus transport. ACC

- Register a death within three working days and order the death certificate before most claims or grants proceed. Govt.nz

- Review affordability each 1 April alongside NZ Super updates; adjust sum insured or indexation if needed.

- KiwiSaver generally forms part of the estate; the personal representative applies under the KiwiSaver scheme rules.

Life Insurance for Senior Citizens in NZ matters when the money would cover immediate costs, clear small debts, and keep your plans intact. Below is a practical, New Zealand-specific guide that shows how the cover works, when it’s worth keeping, what drives price after 60, and the government help most people miss. If you want clear numbers and next steps, compare seniors’ options in minutes and see how different sums insured affect your budget. Start your quote at Compare Life Cover.

What is a senior’s life insurance?

Life Insurance for Senior Citizens in NZ is a straightforward contract: you pay premiums, and when you die, a tax-free lump sum goes to your named beneficiary or your estate. Think of it as money arriving exactly when your family needs it most, to cover funeral arrangements, immediate bills, or time off work.

How it works:

- Choose a cover amount that matches debts, final expenses, and any gift you want to leave.

- Answer health and lifestyle questions; simpler policies exist for small sums, but may cost more per dollar.

- Keep premiums paid so the policy stays in force, and review the amount annually.

- At claim time, provide documents and bank details; the benefit is then paid to the beneficiary or estate.

Documents families will need:

- Register the death within three working days of burial or cremation, then request the official death certificate.

- Use the End of Life Service checklists to track tasks and who to notify.

Keep beneficiary details current so the right person is paid quickly. Avoid surprises later. Want help deciding an amount? Use our quick notes below, or skip ahead and compare options now. Start a comparison at Compare Life Cover.

Do seniors still need it?

Life Insurance for Senior Citizens in NZ is worth keeping, starting, or right-sizing when the payout would relieve real financial pressure on your family.

It usually makes sense if you:

- Have a partner or dependants who would struggle without your income, savings, or contributions.

- Carry debt that you want cleared rather than deducted from the estate, such as a small mortgage or card balance.

- Prefer a guaranteed legacy for children, grandchildren, or a favourite cause.

- Want funeral costs covered beyond any government assistance available.

You might not need it if you:

- Have no dependants, no debt, and enough savings or prepaid arrangements to cover final expenses.

- Hold ample, liquid assets that can be accessed quickly by your executor without distress sales.

Right-size your cover in three steps:

- Estimate final expenses for the service, burial or cremation, travel, and administration.

- Subtract any likely grants from ACC, Work and Income, or Veterans’ Affairs so you avoid over-insuring.

- Add debts you want cleared and a small buffer for surprises, then choose the nearest cover level.

Budget tip (NZ-specific): Review affordability each 1 April when NZ Super rates update, and adjust the sum insured or indexation if needed.

Still unsure? Compare seniors’ options now at Compare Life Cover and see how different amounts change premiums. Small tweaks prevent lapses tomorrow.

Costs after 60 — what drives price and how to keep it affordable

Life Insurance for Senior Citizens in NZ typically costs more with each older age band, but you still have meaningful levers to keep premiums realistic.

What pushes premiums up

- Age banding: premiums step up as you enter higher age ranges.

- Health and lifestyle: new diagnoses, medications, and smoking status matter.

- Cover size and extras: bigger sums insured and optional riders increase the cost.

- Payment gaps: missed premiums can suspend cover until reinstated, risking a declined claim.

What you can control

- Right-size the sum insured: match debts and final expenses, minus any government support you’re eligible for.

- Choose a premium style that fits your time horizon: stepped for shorter terms, level to smooth costs.

- Trim non-essential add-ons you no longer need in retirement.

- Review each 1 April with NZ Super changes, adjusting cover or indexation to avoid lapses. Work and Income

Indexation (CPI) — on or off?

Indexation keeps the payout in step with rising prices, but it also nudges premiums up over time; many retirees switch it off once major debts are gone.

An easy affordability framework

- Set a monthly premium ceiling based on your pension income and essentials.

- Stress-test the policy for a small price rise next year so it still fits.

- If affordability tightens, reduce the sum insured before cancelling to preserve key protection.

Want numbers you can live with? Compare seniors’ life insurance now at Compare Life Cover. Small tweaks compound into lasting savings.

The government help most people miss (so you don’t over-insure)

Life Insurance for Senior Citizens in NZ should be sized after you check whether public support could contribute to funeral and related expenses.

The big three support

- ACC — injury-related deaths: a funeral grant of up to $7,990.30 can be paid to a funeral director or reimbursed; partner and dependent survivor’s grants may also apply.

- Work and Income — Funeral Grant: up to $2,616.12 for essential costs only; it’s income and asset tested.

- Veterans’ Affairs — Funeral Expenses: $3,197.64 for funeral costs, plus transport contributions of $850.80 within a locality or $1,701.61 between localities, with offsets if other agencies also pay.

How to use this

- Check eligibility first: injury-related, service-related, or limited estate funds trigger different rules and evidence.

- Deduct likely grants from the funeral amount you’re planning for so you avoid over-insuring.

- Avoid double-counting because some payments are offset against each other.

- Keep proof handy and follow the checklists so approvals and reimbursements run smoothly.

Be realistic about timing: applications require paperwork, and some assessments can take weeks, especially if medical or coroner reports are needed. Build your cover to stand on its own, then treat grants as helpful refunds that reduce the amount the family must withdraw from savings. Keep copies of everything handy.

Want help estimating a right-sized amount after grants? Start Compare Now.

Estate planning basics tied to your policy

Life Insurance for Senior Citizens in NZ pays out more smoothly when your will, executors, and supporting documents are up to date and easy to find.

Essentials to review

- Make or update a valid will and name an executor; the High Court handles probate and letters of administration when needed.

- Register a death within three working days of burial or cremation, then order the death certificate for claims and estate tasks.

- Tell Inland Revenue that tax records, refunds, and obligations are updated for the estate. Inland Revenue

- List the policy location, beneficiary details, and bank information in a simple folder.

KiwiSaver and property basics

- KiwiSaver typically becomes part of your estate, and your personal representative applies for the funds under the scheme rules.

- Generally, there’s no tax when you inherit property, but tax may apply later if the asset is sold.

- Transfers of residential property on death are not taxed under the bright-line test, and later sales by beneficiaries are also excluded.

Make claiming simple

- Use a service like End of Life Service to build a plan and print checklists for the executor.

- Store certified copies of ID and the death certificate with the policy schedule and contact details.

Real NZ scenarios (worked examples)

Life Insurance for Senior Citizens in NZ is most effective when it’s tailored to realistic situations rather than guesswork.

Scenario 1: Retired couple with a small mortgage

- Starting point: $55,000 mortgage balance and $10,000 set aside for service costs.

- Government offsets: not injury-related, so ACC funeral funding is unlikely; a Work and Income Funeral Grant may contribute if essential costs can’t be met.

- Right-sized cover: target around $65,000, then round to the nearest level you can comfortably afford.

Scenario 2: Single retiree with a prepaid funeral

- Starting point: core funeral costs prepaid; allow $5,000 to $10,000 for travel, notices, and administration.

- Government offsets: if the estate falls short, Work and Income may contribute toward essential items up to the maximum amount.

- Right-sized cover: choose a small amount, or none, if savings fully cover the gap.

Scenario 3: Qualifying veteran

- Starting point: $10,000 funeral budget.

- Government offsets: Veterans’ Affairs pays $3,197.64 for funeral costs plus transport contributions; offsets apply if ACC or Work and Income also pay.

- Right-sized cover: aim for about $6,800 after likely contributions, then select the closest policy level. If death is injury-related, check ACC as it may substantially change the maths.

These examples are starting points, not prescriptions; your health, debts, and appetite for leaving a legacy will change the amount. Use them to frame a range before comparing quotes. Prefer a calculation? Start a life insurance comparison at Compare Life Cover, and we’ll run the numbers with you.

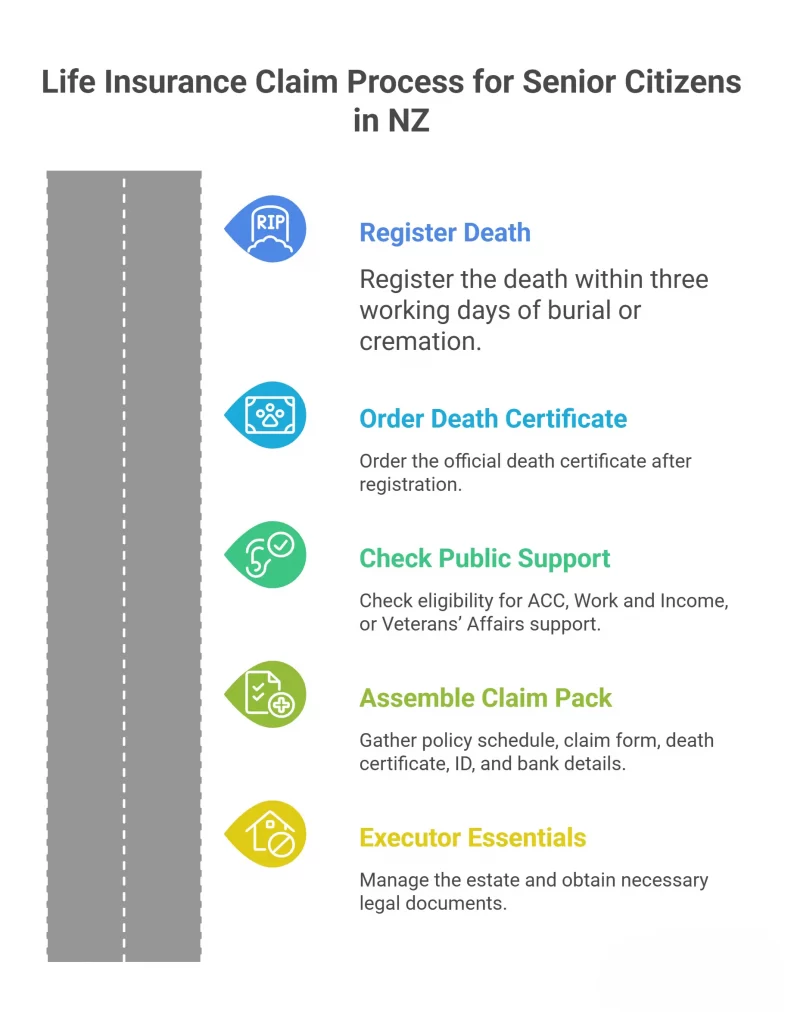

Claims in later life — what families should do first

Life Insurance for Senior Citizens in NZ pays out fastest when you follow a simple sequence and gather the right documents early.

Step 1: Register the death and order the certificate

If a funeral director isn’t handling it, register the death within three working days of the burial or cremation, then order the official death certificate.

Step 2: Check public support

For injury-related deaths, ACC can contribute to funeral costs and may pay survivors’ grants; Work and Income and Veterans’ Affairs can also help in specific cases.

Step 3: Assemble the insurer claim pack

Keep together the policy schedule, claim form, the death certificate, certified ID, beneficiary or executor details, and bank account evidence. (Govt.nz explains why certificates are often needed for estates and grant applications.)

Step 4: Executor essentials

The executor manages the estate and may need probate or letters of administration from the High Court before distributing funds; check official guidance for fees and timelines.

Quick checklist

- Death registered; certificate ordered; copies stored with the policy.

- Public support is checked, and applications are lodged if eligible.

- Insurer claim pack assembled (policy, ID, bank details).

- Executor appointed and contact details shared with the insurer when requested. (Inland Revenue also provides steps for notifying them and timeframes.)

Questions about process or timing? Visit our FAQs or start Compare Now

Tools and checklists

A small amount of organisation makes later claims much easier and keeps premiums aligned with your budget.

Pre-application

- Write down your preferred cover amount and why you chose it.

- List your GP and current medications to keep the forms simple.

- Confirm beneficiary details and how the benefit should be paid.

- Create a documents folder that your executor can access quickly.

Annual review

- Align the review with NZ Super updates on 1 April and check affordability.

- Reduce the sum insured as debts shrink, not after the policy lapses.

- Pause indexation if bigger premiums no longer add real value.

Claim-readiness pack

- Death registered within three working days; certificate ordered and copied.

- Policy schedule, bank details, and certified ID are stored together.

- End of Life Service checklist printed and contact list updated.

Ready to start? Compare seniors’ life cover in minutes at Compare Life Cover

Related reading (internal links)

Strengthen your decision with quick reads from our site:

- Life insurance vs mortgage protection — avoid doubling up on cover.

- Top 5 Key Factors To Choose The Best Life Insurance Provider in NZ — factor balances into estate planning.

Prefer to see numbers? Compare seniors’ options now

Frequently asked questions

Q: What is seniors’ life insurance in New Zealand?

A: It pays a lump sum to a beneficiary or your estate when the insured person dies, helping cover funeral costs, small debts, and a modest legacy.

Q: What documents are needed to make a claim?

A: Register the death within three working days, order the official death certificate, then provide the policy schedule, ID, beneficiary or executor details, and bank account evidence.

Q: Can the government help with funeral costs?

A: Yes. ACC may fund funeral costs after injury; Work and Income can help with essential items; Veterans’ Affairs contributes to funeral costs and transport.

Q: What happens to KiwiSaver when someone dies?

A: The savings usually form part of the estate. The personal representative applies under KiwiSaver rules, and funds are released once approved.

Q: Do we pay tax when property is inherited?

A: Generally, no tax on inheritance, though tax can apply if the asset is sold. Transfers on death and later beneficiary sales are excluded from the bright-line rules.

Final word

Life Insurance for Senior Citizens in NZ is about certainty: a clear sum that arrives quickly so your family can cover essentials without stress. Ready to move forward? Compare Now

Latest Post

- Life Insurance for Senior Citizens in NZ: The 2025 Master Guide

- AIA’s Specialist and Testing Support – New Health Benefit Explained

- How Much Life Insurance in NZ Do Kiwis Need? 2025 Expert Guide

- Life Insurance vs Mortgage Protection in NZ: Key Differences

- Best Life Insurance Policies in NZ 2025: Expert Kiwi Guide