Total and Permanent Disability (TPD) Insurance in New Zealand

Table of Contents

ToggleWhat Is Total and Permanent Disability (TPD) Insurance and Why Does It Matter?

Total and Permanent Disability (TPD) Insurance — sometimes called Disability Insurance — is vital financial protection in New Zealand. It pays you a tax-free lump sum if you suffer a serious illness or injury that permanently prevents you from working again.

Whether you’re a self-employed tradie, a professional with a mortgage, or raising a family, TPD insurance gives you a financial fallback if your income disappears due to disability.

📌 What Does “Total and Permanent Disability” Actually Mean?

In NZ, this typically refers to:

- A medically certified irreversible condition

- That prevents you from returning to your occupation (for some policies) or any job you’re qualified for

- Confirmed by one or more medical professionals, including specialists

💡 Pro Tip: Always check whether your policy defines TPD based on “own occupation” or “any occupation”. This has a significant impact on claim eligibility.

🔍 Why It Matters for Kiwis

Let’s be honest — no one expects to become disabled. But accidents, illnesses, and chronic conditions don’t discriminate. They happen to young and older Kiwis alike, and when they do, your ability to earn income disappears quickly, even though the bills don’t.

For most New Zealanders, ACC may help if the disability is caused by an accident, but it doesn’t cover illnesses like cancer, stroke, MS, or Parkinson’s. On the other hand, WINZ (Work and Income NZ) may offer financial aid, but it’s capped and means-tested. That often leaves a huge gap between what’s needed and what’s received.

That’s where TPD insurance fills the gap. Your payout can help you:

✅ Modify your home or vehicle for accessibility.

✅ Fund private treatment or long-term rehabilitation.

✅ Replace decades of lost income.

✅ Pay off significant debts or start a new career path.

✅ Maintain independence without relying on government benefits.

🧠 Real-World NZ Example:

A Christchurch father in his early 40s was diagnosed with early-onset Parkinson’s. Unable to return to his logistics role, he received a $300,000 TPD payout. He used the money to clear debt, adjust his home, and take on part-time administrative work that better fit his condition.

Want to learn how to compare providers and premiums? Read: 👉Top 5 Key Factors to Choose the Best Life Insurance Provider in NZ

Want to Know What You Could Save? Try the

🔎 How TPD Insurance Works in New Zealand

In Aotearoa, Total and Permanent Disability (TPD) insurance — or disability insurance — acts as a safety net when you can no longer work due to a life-changing illness or injury. It’s available through:

🧩 Three Main Formats:

✅ Standalone TPD Cover

○ Purchased separately from other policies

○ Pays a full benefit without reducing life insurance

✅ Accelerated TPD (Linked to Life Cover)

○ Cheaper option bundled with your life insurance

○ If you claim on TPD, your life cover is reduced by that amount.

○ You can often “buy back” your life cover later.

✅ Bundled Plans

○ Often include trauma, income protection, and TPD in one package.

○ Can be cost-effective and convenient for families or business owners

💡 Pro Tip: Want flexibility? Standalone TPD gives you full benefits without affecting other covers — ideal for self-employed Kiwis.

✅ How a TPD Claim Works

To make a successful claim, most insurers require:

| Requirement | Description |

| ✅ Irreversible Condition | You must have a permanent, incurable medical condition — e.g., spinal injury, advanced MS, severe mental illness |

| ✅ Work Inability Certification | You can’t return to either your own job or any job based on your skills and training, depending on the policy |

| ✅ Medical Documentation | Specialist reports, GP assessments, and ongoing treatment history are crucial |

| ✅ Waiting Period (if applicable) | Some policies include a 3–6 month waiting period before claims are paid out |

📌 Tip: Mental health and neurological claims often require longer assessment times and more detailed support documents.

To better understand your rights during a claim, visit Citizens Advice Bureau NZ – Disability & Insurance Claims

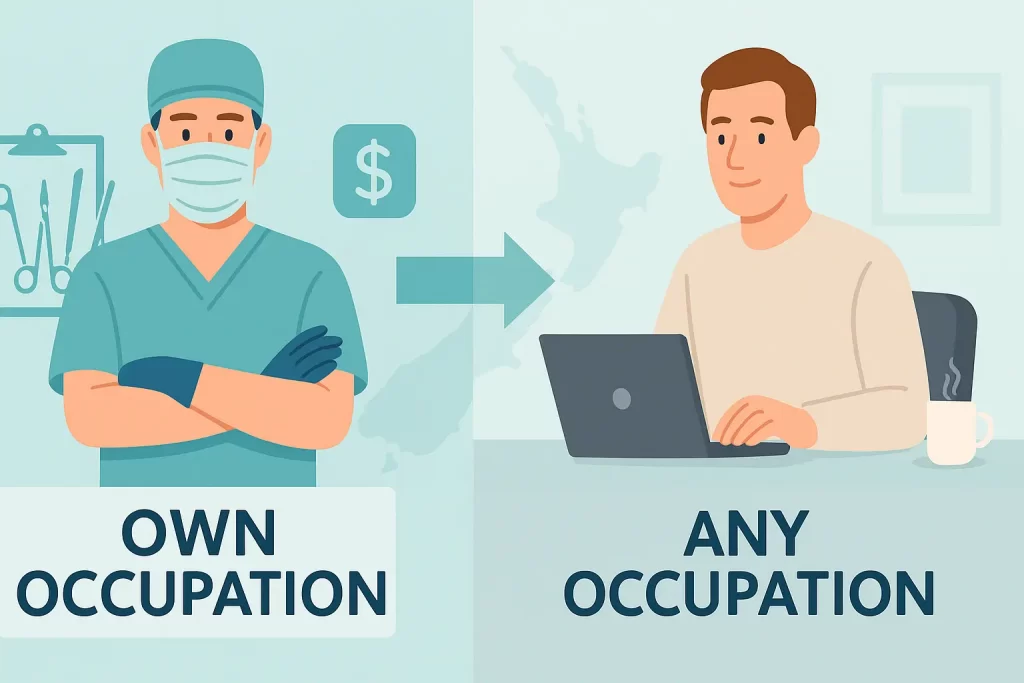

🧾 Types of TPD Insurance Cover in NZ: Own Occupation vs Any Occupation

When selecting Total and Permanent Disability (TPD) insurance, one of the most important decisions you’ll make is choosing between Own Occupation and Any Occupation definitions. These determine when a claim will be paid and significantly impact affordability and eligibility.

In New Zealand, there are two main types of TPD cover:

1️⃣ Own Occupation TPD

This policy pays out if you become permanently disabled and can’t return to the exact job you had before your illness or injury.

✅ Best For:

- Surgeons

- Electricians

- Builders

- Dentists

- Other professionals requiring specific physical or technical skills

📌 Why It’s Easier to Claim: Even if you could technically do another job (like admin work), you’ll still receive a payout if you can’t return to your specialist role.

🛠️ Example:

A 42-year-old dentist in Auckland develops a hand tremor and can’t safely perform dental work. They can still consult or teach, but their policy still pays out — because they can’t do dentistry.

💰 Downside: Higher premiums due to broader eligibility.

📎 Related read: Top 5 Key Factors to Choose the Best Life Insurance Provider in NZ

2️⃣ Any Occupation TPD

This cover only pays out if you cannot work any job reasonably suited to your education, training, or experience.

📌 Why It’s More Affordable: Insurers may reject claims if you can still do some form of work.

🎓 Example:

A high school teacher with chronic fatigue can’t teach in person but could work part-time as an online tutor. That means they might not qualify under this definition.

- Premiums are lower, but meeting the claim criteria is more difficult.

🔍 Which One Should You Choose?

- If your career depends on physical precision or licensing (e.g., surgeons, pilots), Own Occupation gives better peace of mind.

- If your goal is affordable coverage with basic protection, Any Occupation may be suitable, especially when combined with income protection insurance.

🔍 Side-by-Side Comparison Table

| Feature | Own Occupation | Any Occupation |

| Definition of Disability | Can’t return to your specific job | Can’t return to any suitable job |

| Premium Cost | Higher | Lower |

| Claim Approval Rate | Easier to meet the criteria | More difficult |

| Best For | Skilled trades, professionals | General workers, budget-conscious |

| Real-World Example | Surgeon with tremors | Admin worker with chronic fatigue |

👉 Learn how your occupation class affects insurance premiums in our Life Insurance Policies in NZ guide

💡 Pro Tip:

Not all NZ insurers offer Own Occupation cover — especially for high-risk roles. Always ask your adviser or check the policy fine print.

When setting up your TPD insurance in New Zealand, you’ll usually choose between:

🔗 Standalone vs Linked TPD Cover: Which Is Right for You?

New Zealand has two primary options for total and permanent disability (TPD) coverage: standalone or linked (accelerated) cover. Both have benefits depending on your budget, lifestyle, and existing insurance.

1️⃣ Standalone TPD Insurance

This type of policy pays out your TPD lump sum regardless of any other life cover you have. It operates as a completely independent benefit.

✅ Pros:

- You get the full TPD amount, without affecting life insurance

- Greater flexibility for long-term financial planning

- Keeps your life insurance intact after a TPD claim

🚫 Cons:

- Premiums are slightly higher than linked policies

- Separate application process (for some providers)

🧑💼 Example:

Daniel, a self-employed IT consultant, had $300k in standalone TPD and $300k in life cover. After a stroke left him unable to work, his TPD claim was paid, and he kept his full life cover intact.

🟢 Best For:

Self-employed individuals, contractors, or anyone who doesn’t have a bundled life insurance policy.

2️⃣ Linked (Accelerated) TPD Insurance

This is a cheaper option, where your TPD cover is added to your life insurance. If you claim TPD, that amount is deducted from your life insurance balance.

✅ Pros:

- Lower monthly premium

- Great for Kiwis on a tight budget

- Easy to bundle with other insurance

🚫 Cons:

- Reduces your life insurance payout

- May require a buyback to restore cover (extra cost)

🧑🤝🧑 Example:

Lisa had $500k life cover with $200k linked TPD. When she became permanently disabled due to a degenerative condition, her insurer paid $200k, leaving $300k for her family’s future life claim.

📊 Side-by-Side Comparison

| Feature | Standalone TPD | Linked (Accelerated) TPD |

| Independent Payout | ✅ Yes | ❌ No (reduces life cover) |

| Premium Cost | Higher | Lower |

| Life Cover Affected | ❌ No | ✅ Yes |

| Recommended For | Self-employed, full coverage | Budget-conscious or younger Kiwis |

| Claim Impact | Keeps all cover intact | Requires buyback to restore cover |

💬 Pro Tip:

Ask your insurer if they offer a “Life Buyback Option”. This option lets you restore your life cover without another medical check after a TPD payout.

🔗 Want to explore both options? Check out our full breakdown of life insurance policies in NZ to help you decide which TPD setup best suits your needs.

👥 Who Needs TPD Insurance in NZ?

If your income supports your lifestyle, or your family relies on you financially, TPD insurance isn’t optional. It’s essential.

Here’s who benefits most from this kind of protection:

🧑🔧 Self-Employed Kiwis & Freelancers

You don’t get sick leave. There’s no employer-paid insurance. If you can’t work, there’s no backup — unless you create one with TPD.

👨👩👧 Parents with Dependants

If your children, spouse, or elderly relatives depend on your income, TPD cover can secure their future, even if you can’t work again. It can also help fund childcare or education costs.

🏡 Mortgage Holders

Your house is likely your biggest asset and loan. A TPD lump sum can help pay off the mortgage, remove financial pressure, and let you stay in your home without stress.

🧰 Tradies or Physical Workers

Injuries can be career-ending if your job depends on strength, mobility, or coordination. TPD provides income replacement and retraining options if you’re forced to leave your trade.

🧑🌾 Rural Workers & Contractors

Kiwis working in agriculture, forestry, and contracting often face greater physical risk and less access to employer benefits. TPD cover ensures protection tailored to your unique working conditions.

📌 Pro Tip: If you’re self-employed or a contractor, consider pairing TPD cover with income protection insurance for broader financial security.

What Does TPD Insurance Cover in New Zealand?

Total and Permanent Disability (TPD) insurance provides a tax-free lump sum payout when a serious, irreversible condition prevents you from working in your own or any suitable occupation (depending on your policy type).

Here’s a breakdown of the most commonly covered conditions in NZ:

🔹 Loss of Limbs or Paralysis

If you lose the use of two or more limbs or suffer complete paralysis, most insurers will approve your claim.

🛠️ Example: A Northland builder who became paraplegic after a scaffolding accident was paid out under his TPD policy. He used the funds to retrofit his home and retrain as a health and safety consultant.

🔹 Blindness or Deafness

If you suffer total loss of vision in both eyes or total loss of hearing in both ears, you may qualify, especially if the condition prevents you from returning to work.

🔍 Note: Some policies allow partial disability claims if one eye or ear is affected and your job relies on it (e.g., a sound engineer).

🔹 Neurological & Degenerative Conditions

These include:

- Parkinson’s Disease

- Multiple Sclerosis (MS)

- Motor Neuron Disease

- Early-Onset Alzheimer’s or Dementia

If the condition significantly impacts mobility, memory, or function, it can qualify under TPD.

📌 Insider Insight: Claims are stronger with a neurologist’s letter confirming work incapacity and progressive decline.

🔹 Severe Burns or Spinal Cord Injuries

Third-degree burns affecting a significant percentage of your body, or spinal injuries causing permanent loss of movement or function, are typically covered.

🔹 Mental Illness (If Proven to Be Permanent)

While mental health claims are more complex, chronic, treatment-resistant conditions may be covered:

- Schizophrenia

- Severe PTSD

- Bipolar Disorder

- Clinical Depression (with long-term impact)

💬 Pro Tip:

Medical professionals must deem your condition permanent and irreversible to qualify for a full TPD payout, regardless of the cause.

🧠 Mental Health & TPD: What NZ Insurers Consider

Mental illness is now one of the top three causes of long-term disability in New Zealand. However, it remains one of the most misunderstood areas in the insurance world, especially regarding Total and Permanent Disability (TPD) claims.

Unlike physical injuries, mental health conditions aren’t always visible, which means documentation, treatment compliance, and long-term stability play a crucial role in your eligibility.

✅ What Counts Toward a Mental Health–Based TPD Claim?

Insurers in NZ will look closely at the following when assessing mental health claims:

| Criteria | What They Look For |

| 📋 Diagnosis | A formal diagnosis from a psychiatrist (e.g. PTSD, bipolar, major depressive disorder) |

| 🧾 Treatment History | Records showing ongoing care, therapy, and prescribed medications |

| 💬 Work Impact | How does the condition affect your ability to function in any suitable job |

| 🧑⚕️ Medical Reports | Statements from GPs, psychologists, and mental health professionals |

| ⏳ Duration | Prolonged symptoms (typically 12–24+ months) with little to no improvement |

📍 Real-World NZ Example

A Wellington-based graphic designer was diagnosed with chronic PTSD after surviving a car accident. Despite therapy and medication, she couldn’t return to work after two years. Her TPD claim was approved, thanks to:

- Strong documentation from her psychiatrist

- Failed return-to-work efforts logged by her employer

- A supporting letter from her GP confirming long-term impairment

She received a $250,000 lump sum payout, allowing her to pay off debts and prioritise recovery.

🚨 What Makes Mental Health Claims Challenging?

Unlike a broken leg or paralysis, mental health doesn’t always show up on a scan. That’s why insurers demand:

- Long treatment history (not just a few months of stress leave)

- Evidence of failed rehab or work trials

- Consistency — jumping from one practitioner to another without progress may raise flags.

🧠 Helpful Tips to Strengthen a Mental Health–Based TPD Claim

- 🔄 Keep a well-documented treatment history (appointments, diagnoses, meds)

- 📝 Request written statements from all professionals involved in your care

- 🧑⚕️ Ask your GP or psychiatrist to explain how your condition affects all work functions (not just your current job)

- 📚 Keep a personal journal to track symptoms, setbacks, and failed return-to-work efforts

📌 Pro Tip:

Some NZ insurers are updating policies to accommodate mental illness better, especially if you’ve been stable in care. Always ask your adviser which providers are most mental health friendly.

📊 Premium Costs in NZ: What to Expect

When Kiwis ask, “How much does TPD insurance cost?” The honest answer is: it depends.

Your premium is based on a risk profile that includes your age, health, job, lifestyle, and how much cover you want.

Let’s break down what affects your premium and what you can do to influence it.

🔍 What Influences TPD Premiums?

| Factor | How It Affects Premiums |

| 🧑 Age | Premiums increase as you age — locking in early = long-term savings |

| 🚬 Smoking/Vaping | Smokers can pay 50–70% more than non-smokers |

| 💼 Occupation | High-risk jobs (e.g., tradies, forestry workers) may have higher premiums |

| ⚕️ Health History | Chronic illness, high BMI, or pre-existing conditions can increase rates |

| 💲 Cover Amount | $500k cover costs more than $100k — but not 5x as much, thanks to banded pricing |

| 👤 Gender (sometimes) | In rare cases, gender may impact premiums slightly based on claims data |

📈 Sample Premium Table

| Age | Smoker? | Occupation | Cover | Monthly Premium |

| 30 | No | Architect | $300k | $28–$36 |

| 42 | Yes | Tradie | $400k | $65–$85 |

| 50 | No | Manager | $500k | $90–$120 |

💡 These are typical NZ rates across mainstream insurers — your actual quote may vary.

📌 How to Get Lower TPD Premiums

- ✅ Quit smoking — after 12 months, you may qualify as a non-smoker

- ✅ Improve your health — lower BMI, stable conditions, and an active lifestyle help

- ✅ Bundle your cover — combine TPD with life or trauma insurance for discounts

- ✅ Compare before locking in — each insurer rates risk differently

📣 Real Kiwi Example

Mark, 36, an Auckland-based graphic designer, started with a $400,000 TPD policy at $72/month.

After losing 9kg and quitting vaping for a year, he reapplied. His premium dropped to $52/month, saving him over $240 annually.

Ready to check your rate now?

Use our free Compare Life Cover to instantly compare premium quotes from top NZ insurers.

🧠 Pro Tip:

Start early. TPD policies taken out in your 20s or early 30s can be significantly cheaper and give you lifetime protection.

🚨 Claiming TPD in NZ: The Process (Step-by-Step)

Filing a Total and Permanent Disability (TPD) claim in New Zealand can seem daunting, especially if you’re already navigating a life-altering medical condition. But understanding the process — and what insurers look for — can make a huge difference in how smoothly things go.

Here’s a clear breakdown of what to expect when lodging a TPD claim:

🧾 Step 1: Notify Your Insurer or Adviser

As soon as your condition is diagnosed as potentially permanent and work-limiting, let your insurance provider or adviser know. They’ll supply a claims pack and help you get started.

✅ Pro Tip: Your adviser can help you pre-check eligibility and gather strong medical evidence before formally submitting.

📄 Step 2: Complete the TPD Claim Form

Fill in the official TPD claim form with detailed information on:

- Your medical diagnosis and the condition’s history

- The date you last worked

- Your current symptoms and treatment

- The impact on your daily activities

- Information about your job, skills, and prior employment

💡 Tip: Be honest, detailed, and consistent. Any contradictions can delay assessment.

🩺 Step 3: Submit Medical Documentation

You’ll need to include:

- GP or specialist medical reports

- Hospital discharge summaries (if applicable)

- Psychological/psychiatric assessments (if relevant)

- Proof of your inability to return to work

✅ Pro Tip: Some insurers require confirmation from two independent doctors. Make sure both support your claim.

🧑⚕️ Step 4: Attend Insurer Assessments (If Required)

Depending on your case, your insurer may request:

- An Independent Medical Examination (IME)

- A Functional Capacity Evaluation (FCE)

- A Vocational Assessment to evaluate what work (if any) you can still do

📌 These assessments can feel invasive, but they’re standard, and being cooperative helps your case.

📊 Step 5: Underwriting Review and Decision

Once all information is submitted:

- The claims team will assess whether your condition meets the TPD definition in your policy

- They’ll consider the irreversibility of the condition.

- They’ll determine whether you can reasonably return to any work (especially for “Any Occupation” cover)

⏳ Timeframe: Most claims take 4–12 weeks, but complex cases (especially mental health or neurological) can take longer.

💸 Step 6: Receive a Tax-Free Lump Sum (If Approved)

If successful, you’ll receive your agreed lump sum payout. This money is tax-free in NZ and can be used however you choose — paying off debt, modifying your home, or funding long-term care.

✅ Pro Tip: TPD benefits are not taxed in New Zealand — it’s 100% yours.

❌ What If My TPD Claim Is Declined?

It happens — but that doesn’t mean you’re out of options.

You can:

- Request a formal review with additional documentation

- Ask your adviser to help escalate or mediate.

- Complain with the Disputes Resolution Scheme (required for all NZ insurers)

- Reach out to the Citizens Advice Bureau NZ for free help.

📌 If you’re declined due to unclear medical evidence, consider gathering more assessments from specialists.

🧠 Real NZ Claim Example:

Lena, a 44-year-old copywriter in Wellington, developed treatment-resistant depression after a traumatic incident. Despite seeing a psychologist and psychiatrist for over two years, she couldn’t return to any form of work. Her claim was initially delayed but later approved when she submitted three years’ worth of clinical notes, work re-entry attempts, and two psychiatric evaluations confirming her prognosis.

💰 She received a $250,000 tax-free lump sum, which helped her pay off debt and transition into a supported living situation.

Want to see which TPD insurers have the best claim support track record?

🚫 What’s Not Covered by TPD Insurance in New Zealand

While Total and Permanent Disability (TPD) Insurance offers robust protection, it doesn’t cover every situation. Like all insurance products, your policy has clear exclusions that could affect whether a claim is accepted.

Here’s a breakdown of the most common exclusions — and how to work around them 👇

1. Temporary or Recoverable Conditions

If your condition is not permanent — even if it takes years to recover — it likely won’t meet the TPD threshold.

🧠 Example: A back injury that keeps you off work for 18 months but shows signs of recovery will not qualify, even if it impacts your life in the short term.

✅ Pro Tip: Consider pairing your TPD policy with Income Protection Insurance to cover temporary loss of work due to illness or injury.

2. Pre-Existing Conditions (Not Disclosed)

If your condition is not permanent — even if it takes years to recover — it likely won’t meet the TPD threshold.

3. Drug- or Alcohol-Related Incidents

If your disability is caused (or worsened) by drug use, substance abuse, or alcohol-related events — and those weren’t disclosed or treated — your claim might be excluded.

🧠 Example: A car accident caused by intoxication that results in permanent disability could be excluded, depending on the circumstances and your policy wording.

4. Dangerous or High-Risk Activities (Undeclared)

If you regularly participate in extreme sports or high-risk hobbies (e.g., skydiving, scuba diving, rock climbing) and didn’t inform your insurer, any related injury may be excluded.

📌 Some insurers will cover you if you disclose it beforehand.

5. Criminal Activity or Self-Inflicted Harm

TPD claims related to criminal activity, self-inflicted injury, or attempted suicide may be rejected, depending on the policy wording and circumstances.

6. Mental Health Without Medical Support

Claims based on undiagnosed or unsupported mental health conditions may not qualify. Insurers require psychiatric assessments, long-term treatment records, and proof that work capacity is permanently impacted.

✅ Pro Tip: Want mental health coverage from day one? Look for insurers with mental health-friendly underwriting. You can compare them here.

📌 Summary Table: Common Exclusions in NZ TPD Policies

| Exclusion Type | Covered? | Notes |

| Temporary conditions | ❌ No | Must be permanent, irreversible |

| Undisclosed pre-existing illness | ❌ No | Must be disclosed during the application |

| Drug or alcohol-related events | ❌ No | Unless previously disclosed and treated |

| Extreme sports (if not declared) | ❌ No | May be included if declared and agreed upon |

| Mental illness without diagnosis | ❌ No | Psychiatric records and ongoing treatment are required |

| Injury from crime or reckless acts | ❌ No | Activities involving criminal behaviour are typically excluded |

🔎 Want to Avoid These Pitfalls?

Use our trusted tool to find:

- Insurers that are mental health-friendly

- Policies that allow buybacks or waivers

- Cover options based on your lifestyle and risk profile

Compare TPD Insurance Providers in NZ

🔁 How TPD Insurance Interacts With Other Insurance in New Zealand

Total and Permanent Disability (TPD) Insurance rarely stands alone. In New Zealand, many people combine TPD with life insurance, trauma insurance, and income protection to create a comprehensive financial safety net.

Let’s break down how they complement each other.

✅ TPD + Life Insurance

Many insurers offer TPD as an accelerated benefit within a life insurance policy. This means:

- If you become permanently disabled, your life insurance amount is reduced by the amount paid for TPD.

- For example, if you have $500,000 in life cover and claim $300,000 in TPD, your remaining life insurance is $200,000.

📌 Note: You can also choose a standalone TPD, which pays out separately and doesn’t impact your life insurance balance.

👉 Learn more: Top Life Insurance Providers in NZ

✅ Best for: People who want long-term protection and flexibility.

✅ TPD + Trauma Cover

Trauma insurance (also called critical illness cover) pays a lump sum upon diagnosis of a listed illness, like cancer, heart attack, or stroke.

How they differ:

- Trauma pays on diagnosis, whether or not you return to work.

- TPD pays only if the condition causes permanent inability to work.

🧠 Combined Approach:

- Trauma cover supports you during recovery

- TPD kicks in if the illness or injury becomes permanent

🔍 Example: A 38-year-old is diagnosed with breast cancer. She uses trauma insurance to fund private treatment. A year later, ongoing complications leave her permanently unable to return to work — her TPD policy then pays out as well.

👉 Compare trauma cover options at Compare Trauma Cover Options

✅ TPD + Income Protection

Income Protection replaces your income monthly if you’re temporarily unable to work due to illness or injury.

TPD, on the other hand, is a one-time lump sum paid if you never return to work.

| Feature | Income Protection | TPD Insurance |

| Payout type | Monthly (up to 75%) | Lump sum (e.g., $300k+) |

| Duration | Until recovery / 2-5 yrs / age 65 | One-time payment |

| Requirement | Temporarily unable to work | Permanently unable to work |

| Recovery allowed? | Yes | No |

🧠 Example: A plumber breaks his back. Income Protection helps for 12 months while he recovers. After doctors confirm permanent disability, he claims TPD for a $500,000 lump sum.

🧩 Create a Layered Strategy

Here’s how your insurance stack could look:

| Type | Covers | Benefit |

| Life Insurance | Death or terminal illness | Supports loved ones |

| TPD Insurance | Permanent disability | Lump sum to replace income |

| Trauma Insurance | Serious illness diagnosis | Cash during recovery |

| Income Protection | Temporary illness or injury | Replaces monthly earnings |

✅ This layered approach means you’re covered for nearly every scenario — from short-term illness to long-term disability to death.

📌 Pro Tip: Review your policy mix every 12–24 months or after a big life event (new job, baby, mortgage).

⚖️ TPD vs Trauma Cover: What’s the Difference?

Although both Total and Permanent Disability (TPD) Insurance and Trauma Cover offer lump-sum payouts, they serve very different purposes and are triggered by different life events.

Here’s a clear side-by-side comparison:

| Feature | TPD Insurance | Trauma Insurance |

| Payout Trigger | Permanent inability to ever return to work (own/any occ) | Diagnosis of a listed serious illness |

| Work-Related | Yes — must impact the ability to work permanently | No payout is based on diagnosis, regardless of work |

| Examples Covered | Paralysis, loss of limbs, blindness, permanent brain injury | Cancer, heart attack, stroke, multiple sclerosis |

| Return to Work? | No — must be unlikely to work again | Yes — can still claim even if full recovery is expected |

| Purpose | Long-term financial replacement/support | Short-term financial support during recovery |

| Common Use | Mortgage repayment, home modifications, and long-term care | Medical costs, living expenses, and time off work |

🧠 Real Kiwi Scenario

Case 1:

Emma, 41, is diagnosed with breast cancer. She claims trauma cover, which helps fund private treatment and six months off work.

Case 2:

Two years later, Emma develops complications that permanently prevent her from returning to her high-stress marketing role. She then qualifies for a TPD payout due to long-term occupational incapacity.

✅ Together, trauma and TPD provided both immediate relief and long-term security.

🔍 Should You Have Both?

Yes — for most New Zealanders, having both is ideal.

- Trauma Cover helps with short-term crises: hospital bills, rehab, and reduced income during recovery.

- TPD insurance protects you if your condition becomes irreversible, like losing the ability to work again.

🧩 They complement each other, not overlap.

📌 Pro Tip:

Some insurers offer bundled packages that include TPD and trauma under one umbrella, often with discounts or shared benefits.

Do I Need TPD If I Have Income Protection?

Short answer? Yes — absolutely. While Income Protection and Total and Permanent Disability (TPD) insurance are designed to protect your income, they work very differently, and one does not replace the other.

🔗 Why They Work Best Together

- Income Protection = immediate financial support while you heal

- TPD Cover = long-term financial stability if recovery doesn’t happen

If you only have one, you’re leaving a gap. TPD gives you the capital to rebuild your life, survive, and thrive again.

📌 Pro Tip:

Income protection can fund your recovery journey. But if you’re left permanently disabled, only TPD can provide that full payout to cover big-picture needs like mortgage debt, medical costs, or a career change.

🧠 Common Myths Busted

❌ “TPD doesn’t cover mental illness.”

➡️ Wrong. Many NZ providers offer TPD for conditions like PTSD, bipolar disorder, or clinical depression, as long as the condition is medically verified and permanently disabling.

❌ “You can’t get it if you’re not working full-time.”

➡️ Incorrect. Depending on the policy, you can often qualify even if you’re part-time, casual, or self-employed.

❌ “Only physical injuries count.”

➡️ Not true. TPD can cover neurological disorders like Parkinson’s, dementia, and even stroke-related impairments.

🟩 Final Thoughts: Should You Get TPD Insurance?

If you rely on your income — and most of us do — then Total and Permanent Disability (TPD) insurance isn’t just “nice to have”. It’s essential protection for your financial future.

Whether you’re a self-employed Kiwi, a full-time parent, or someone with a mortgage, TPD gives you something that no other cover can: a lump-sum payout to reshape your life if the unthinkable happens.

✅ Why It’s Worth It:

- It’s affordable – TPD cover can cost less than a coffee per week for many New Zealanders.

- It fills the gap between trauma insurance (which pays at diagnosis) and income protection (which pays monthly), TPD secures your long-term financial stability if you can never work again.

- It’s peace of mind – your family won’t have to carry the burden. You won’t have to rely on WINZ or drain your savings to survive.

🧠 FAQS – Quick Answers for Curious Kiwis

1. What qualifies as a total and permanent disability in New Zealand?

A condition that is medically certified as permanent and irreversible and prevents you from working in any job (or your specific job, depending on your policy). This could include serious injuries, neurological disorders, advanced mental illness, or degenerative diseases.

2. Can I get TPD insurance if I have a pre-existing condition?

Yes, many Kiwis with pre-existing health conditions can still get TPD cover. Some conditions may lead to premium loadings or exclusions, but complete transparency during the application helps avoid claim issues later.

Check out our article on how health affects life insurance premiums in NZ.

3. Does TPD cover mental illness?

It can. Claims related to mental health — like PTSD, depression, or bipolar disorder — are possible if the condition is well-documented, long-term, and severely impairs your ability to work. You’ll typically need reports from a psychiatrist and a history of treatment.

4. Can I claim both TPD and income protection insurance?

Yes. Income protection provides monthly payments for temporary disability, while TPD is a lump sum payout for permanent disability. Many Kiwis—primarily the self-employed—have both to ensure short- and long-term financial protection.

5. Can I buy TPD independently, or must it be linked to life cover?

You can do both:

- Standalone TPD pays independently of life cover

- Linked (accelerated) TPD reduces your life insurance balance if claimed

Your choice depends on your budget and financial needs.

6. Is TPD insurance tax-free in New Zealand?

Yes — the lump sum payout is tax-free for personal TPD policies. However, different rules may apply if you hold TPD inside a business or superannuation plan. Always check with a licensed adviser.

🔍 Thinking Long-Term? You should be.

NZ’s public system (like ACC or WINZ) often doesn’t provide enough to maintain your lifestyle or cover long-term care needs.

That’s where TPD comes in — offering freedom, dignity, and choice during the most challenging times.

Use our trusted comparison platform

Latest Post

- Life Insurance for Senior Citizens in NZ: The 2025 Master Guide

- AIA’s Specialist and Testing Support – New Health Benefit Explained

- How Much Life Insurance in NZ Do Kiwis Need? 2025 Expert Guide

- Life Insurance vs Mortgage Protection in NZ: Key Differences

- Best Life Insurance Policies in NZ 2025: Expert Kiwi Guide