Top 5 Key Factors To Choose The Best Life Insurance Provider in NZ

Table of Contents

ToggleChoosing the best life insurance provider might not be your typical dinnertime conversation. Still, if you’re a Kiwi wanting to protect your loved ones or ensure your business survives without you, it’s one of the smartest moves you can make. Whether you’re self-employed, a new homeowner, or simply planning for the future, selecting the right life insurer isn’t just about cost—it’s about trust, flexibility, and long-term value.

In this guide, we’ll walk you through the top 5 factors you should consider, share real stories from fellow New Zealanders, and offer a step-by-step game plan for finding the right provider. You’ll feel confident and clear about your next move by the end.

💡 Pro Tip: Want to skip the research rabbit hole?

Instead of juggling 5+ tabs and comparing life cover on your own, use our Compare Life Cover tool to compare multiple New Zealand insurers —in minutes. It’s fast, 100% free, and made for Kiwis who don’t have time to decode fine print.

Why Choosing the Right Life Insurance Provider Matters

In New Zealand, the idea of “she’ll be right” might work for weekend plans—but when it comes to life insurance, a little planning goes a long way. Your insurer is the company that will support your family if you’re no longer around. That’s not a decision to be taken lightly.

Imagine a young father in Wellington taking out a $500,000 life insurance policy after his first child was born. When a rare illness claimed his life three years later, the payout allowed his partner to stay home with their toddler, pay the mortgage, and take time to heal without worrying about bills. That’s the kind of peace of mind you’re buying.

Let’s break down the five key things to help you find the right insurer for your needs.

Factor 1: Financial Strength and Stability That Stands The Test of Time

A life insurance policy is a long-term promise—promises only matter if they’re kept. That’s why an insurer’s financial strength is the first thing to check.

What It Means

An insurer’s financial stability directly impacts its reliability in honouring claims, especially during economic downturns. A financially robust insurer ensures beneficiaries receive the intended benefits without unnecessary delays or complications.

What to Consider:

- Ratings from Reputable Agencies: Evaluate ratings from agencies like AM Best, Fitch Ratings, or Standard & Poor’s, which assess insurers’ financial health.

- Historical Claims Payment Records: Look for consistent performance in claims settlements, indicating the insurer’s commitment to policyholders.

Top NZ Providers and Their Ratings (2025)

| Provider | Rating | Notable Strengths |

| AIA NZ | AA (Very Strong) | Global backing, digital tools |

| Partners Life | A (Excellent) | Strong local presence, personalised support |

| Fidelity Life | A- (Excellent) | Excellent service, flexible policies |

| Asteron Life | A (Excellent) | Award-winning service, high claims acceptance |

Partners Life: In January 2025, AM Best rated Partners Life Limited as A (Excellent).

Fidelity Life: As of March 2025, Fidelity Life Assurance Company Limited maintained an A- (Excellent) rating from AM Best.

Asteron Life: In February 2025, Fitch Ratings assigned Asteron Life an Insurer Financial Strength (IFS) Rating of ‘A’ (Strong) with a Positive Watch

AIA NZ: AIA New Zealand Limited has been assigned an AA (Very Strong) insurer financial strength rating by Fitch Ratings

Red Flags to Watch

- No rating listed

- Recent financial issues or significant losses

- Poor claim payout history

Use our free Life Insurance Comparison Tool to compare life cover instantly.

Real-Life Insight:

Lisa, a café owner from Auckland, faced a sudden tragedy when her partner unexpectedly passed away. Fortunately, they had previously chosen a financially robust life insurance provider. Lisa received her payout without complications within a few days of submitting the claim. This timely financial support allowed her to cover immediate expenses, manage funeral costs, and sustain her café during emotional and financial stress. The insurer’s strong economic stability provided Lisa with much-needed security.

Pro Tip: Always verify insurers’ current financial strength ratings, as these can change over time.

Factor 2: Policy Option and Flexibility

No two lives are the same, so why settle for a one-size-fits-all insurance policy? Policy flexibility refers to the insurer’s ability to adapt or modify insurance coverage to meet changing life circumstances and financial situations.

Policy variety and flexibility are crucial factors when choosing the best life insurance provider in New Zealand. You want a provider that offers products tailored to your life stage, income, and risk tolerance.

Common Types of Life Insurance in NZ

Choosing the right type of life insurance depends on your unique circumstances and needs. Here’s a detailed breakdown of the common types of life insurance available in New Zealand, explaining what each covers and who they’re ideally suited for:

| Insurance Type | What It Covers | Best For |

| Life Insurance | Provides a lump sum payment to your beneficiaries upon your death or terminal illness diagnosis. | Families, homeowners, and primary income earners |

| Trauma Insurance | Offers a lump sum payment if you’re diagnosed with a specified critical illness (e.g., cancer, heart attack, stroke). | Self-employed business owners and families |

| Income Protection | Pays a monthly benefit if you’re unable to work due to illness or injury, covering your ongoing living expenses. | Freelancers, contractors, business owners |

| Medical Insurance | Covers costs for private medical treatments, surgeries, specialist consultations, and hospitalisation. | Individuals, families, and anyone seeking faster healthcare access |

| Mortgage Insurance | Provides financial assistance to cover mortgage repayments if you cannot work due to illness, injury, or death. | Homeowners, property investors, families with mortgages |

Understanding each insurance type’s specific coverage helps you select the right policies tailored to your personal, family, and business needs.

Why Flexibility Matters

Let’s say you start a business in your 30s. Your income might fluctuate, so you’ll want a policy to adjust your coverage or defer premiums during lean months. Or perhaps you get married or have a child—can your provider help you scale your coverage quickly, without starting from scratch?

Some providers allow:

- Premium holidays: Allows temporary pauses on premium payments without losing coverage.

- Scalable coverage: Easy adjustment of your coverage limits as your personal or financial situation evolves.

- Flexible riders: Optional coverages such as child cover or disability insurance can be added to your primary policy.

💡 Smart Move: Not sure which policy fits your lifestyle?

Compare policies with our free NZ life insurance tool—it’s fast, accurate, and designed for busy Kiwis. It’ll match you with tailored policy options based on your life stage, income, and goals.

🗨️ Real Example:

Sarah, a freelance graphic designer from Christchurch, started with a basic life cover. When her income grew, she added trauma cover and increased her policy—all through her online portal.

Factor 3: Premium Value – Balancing Cost with Comprehensive Protection

When it comes to life insurance, affordability matters—but value matters even more. Sure, you’ll pay premiums each month or annually, but it’s crucial to look beyond the price tag. You must ask yourself, “What exactly am I getting for my money?”

How Premiums Are Calculated in NZ

Life insurance premiums in New Zealand are calculated based on several personal and lifestyle factors, each influencing how much you’ll pay:

- Age: Younger policyholders usually benefit from lower premiums.

- Gender: Premiums may vary slightly between genders.

- Smoking Status: Smokers typically pay higher premiums due to increased health risks.

- Health History: Pre-existing conditions or family health history can affect costs.

- Occupation: High-risk occupations might lead to increased premiums.

- Lifestyle Choices: High-risk activities or hobbies (e.g., skydiving, scuba diving) can also raise your premiums.

Generally, the younger and healthier you are when you purchase your policy, the cheaper your premiums will be over the long run.

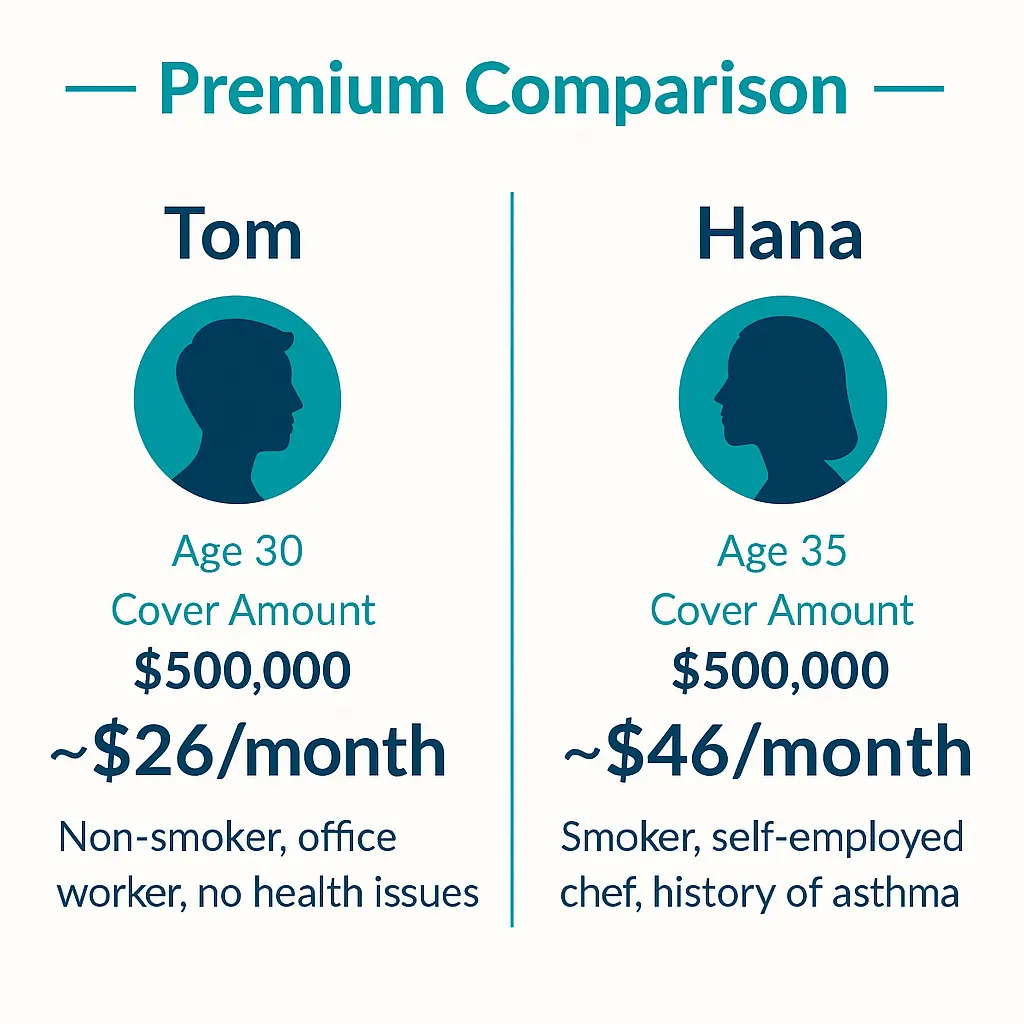

Comparing Two Realistic Scenarios

Let’s take a practical look at two real-life examples to understand how these factors can impact premium affordability:

| Person | Age | Cover Amount | Monthly Premium | Notes |

| Tom | 30 | $500,000 | ~$26/month | Non-smoker, office worker, no health issues |

| Hana | 35 | $500,000 | ~$46/month | Smoker, self-employed chef, history of asthma |

As illustrated, Tom’s premiums are significantly lower due to his younger age, healthier lifestyle, and lower-risk occupation compared to Hana, whose smoking status and health conditions lead to higher costs.

Tips for Getting the Best Value

Want the best bang for your buck? Here’s how you can maximise your value:

- Bundle Your Policies: Combining life insurance with trauma or medical insurance often results in notable discounts.

- Leverage Comparison Tools: Use reputable online tools like Compare Life Cover to easily compare policies and ensure you get the best coverage at a competitive price.

- Seek Loyalty and Wellness Discounts: Providers frequently offer discounts for policyholders who maintain healthy lifestyles or regularly participate in wellness programmes.

Real-Life Example:

Consider Mark, a 32-year-old freelance writer from Auckland. Initially overwhelmed by the choices, Mark used an online comparison tool like Compare Life Cover to evaluate his options. He bundled life insurance with trauma cover, which qualified him for a substantial discount, reducing his premiums by nearly 15%. Mark also benefitted from an additional wellness discount through regular gym attendance and annual health checks provided by his insurer’s rewards programme, bringing even more savings while securing comprehensive coverage.

💡 Did You Know?

Some insurers in New Zealand provide ongoing discounts for policyholders who consistently engage in healthy activities such as exercising regularly, remaining smoke-free, or completing annual health assessments. Adopting a healthier lifestyle can significantly reduce insurance costs while enhancing your long-term well-being.

💡 Money-Saving Tip: Ready to see if you’re overpaying?

Use our Compare Life Cover Calculator to get real-time premium quotes from the best life insurance provider in New Zealand and determine how much you could save.

Factor 4: Claims Process and Reputation – A Provider You Can Count On When It Matters Most

When tragedy strikes, the last thing your family needs is to navigate a stressful or confusing insurance claims process. That’s why selecting a provider with a transparent, efficient, and compassionate claims process is essential. The accurate measure of any life insurance company is how well it handles claims when it matters most.

What Makes a Great Claims Experience?

When reviewing potential insurers, look for these key indicators of a strong claims experience:

- Dedicated Claims Advisor:

A single point of contact can significantly simplify the claims process, guiding your family clearly and compassionately every step of the way. - Clear Documentation Checklist:

Transparency in required paperwork helps avoid delays and ensures smooth claim processing. - Fast Payout Times:

Aim for the best life insurance provider in New Zealand, who typically pays claims within 5–10 business days. This will help your loved ones access funds promptly when needed. - Comprehensive Support Services:

Grief counselling, financial advice, and ongoing support should be provided to ease the emotional and financial burden on your family during challenging times.

Let’s look at how some of New Zealand’s leading life insurance providers stack up: Each provider is reputable, but subtle differences in claims processing times and customer satisfaction scores might influence your decision.

New Zealand Claims Processing Times (2025):

| Provider | Average Claims Processing Time | Notes / Highlights |

| AIA NZ | 5–10 business days | Typically processes claims within 5–10 days. |

| Partners Life | 5–10 business days | Strives to assess claims within 5 days, extending to 10 during peak periods. |

| Fidelity Life | Generally under 10 days | Transparent, supportive claims process; precise times not publicly detailed. |

| Asteron Life | Approximately 2–5 business days after acceptance | Claims are usually paid within 2 days post-acceptance. |

Key Notes:

- AIA NZ and Partners Life explicitly mention a processing goal of 5–10 business days, depending on the completeness of the documentation.

- Asteron Life has a notably faster turnaround time, typically paying out within two business days of accepting the claim.

- Fidelity Life does not specify exact times but emphasises providing timely, supportive assistance through the claims process.

Real-Life Customer Story: How a Best Life Insurance Provider Helped George’s Family

George, a 41-year-old father of three from Hamilton, tragically passed away after a sudden health crisis. His family was devastated—not only emotionally but also financially. Thankfully, George had previously chosen a life cover policy from a well-known provider, and they are known for compassionate and efficient claims handling.

Within six days, his wife received the full claim payout. This rapid response meant she could immediately cover funeral costs, pay off urgent bills, and maintain financial stability. The provider’s dedicated claims advisor personally guided her through every step, offering additional emotional support and financial counselling.

This experience highlights the tangible difference an efficient, compassionate claims process can make during life’s most challenging moments.

Tips for Evaluating Claims Processes:

- Read Customer Reviews and Testimonials:

Check independent reviews, forums, or trusted platforms to gauge real-life customer experiences. - Check Claims Acceptance Rates:

Providers publicly disclosing high-claim acceptance rates demonstrate transparency and confidence in their claims process. - Directly Ask Providers About Their Claims Handling:

Don’t hesitate to contact insurers directly, asking questions like, “How quickly are claims typically processed?” and “What support services are available for families during the claims process?”

💡 Did You Know?

Insurers with robust digital platforms often allow claim tracking online, providing peace of mind and transparency during an emotionally taxing period.

Factor 5: Extras, Add-ons, and Digital Tools- Why They’re A Game-Changer

When comparing life insurance providers, the core coverage matters—but the extras, add-ons, and digital features can elevate your policy. Here’s why you shouldn’t overlook these powerful additions.

Popular Insurance Add-ons: More Coverage, Greater Peace of Mind

Add-ons are specialised coverages you can attach to your central life insurance policy. They offer additional protection and flexibility, ensuring your family is covered for almost every situation life might throw your way.

Here’s a quick rundown of some popular add-ons in New Zealand:

- Funeral Benefit

This add-on provides instant cash (typically around $15,000) to cover funeral expenses, preventing your family from financial stress during a difficult time. - Waiver of Premium

If you become seriously ill or disabled, your insurer will continue paying your premiums, keeping your coverage active even when you cannot work. - Children’s Cover

Receive a lump sum if your child experiences severe illness or passes away, ensuring you have financial breathing room to focus on your family’s emotional recovery. - Critical Illness (Trauma Cover)

Pays an additional lump sum if diagnosed with critical illnesses like cancer, heart attacks, or strokes, helping cover medical bills and daily expenses.

Cutting-Edge Digital Tools: Manage Your Policy Like a Pro

Modern insurers are embracing technology to simplify your experience. Here are some top digital features to look for:

- Online Quotes & Applications

- App-Based Policy Management

- Claims Tracking

- Live Chat & Virtual Consultations

Real-Life Example: How Digital Features and Add-ons Saved Kate’s Family

Let’s consider Kate, a busy marketing manager from Auckland. She chose an insurer because of its robust digital tools and valuable add-ons. Managing her policy through the insurer’s intuitive app made her life easier, allowing her to update details and monitor her payments quickly.

When Kate unexpectedly fell seriously ill with breast cancer, her critical illness add-on kicked in immediately, providing a $100,000 lump-sum payment. These funds covered her medical expenses, household bills, and childcare costs, significantly easing her family’s financial burden during her treatment.

💡 Did You Know?

Insurers like AIA offer wellness programmes (e.g., AIA Vitality) that reward healthy lifestyles with discounts and valuable perks. These incentives can help lower insurance premiums while supporting your health and well-being—a win-win scenario.

Common Mistakes to Avoid When Buying Life Insurance

Choosing life insurance isn’t just about ticking a box. Avoid these pitfalls:

❌ Buying Too Little Cover

A $100,000 policy might sound big, but is it enough to pay off a mortgage, raise kids, and cover funeral costs? Many Kiwis underestimate what their family needs.

❌ Waiting Too Long

Life insurance premiums increase with age. Waiting until your 40s or 50s can cost hundreds more per year. Plus, health issues later in life might exclude you from coverage.

❌ Overlooking Exclusions

Did you know some policies don’t cover certain medical conditions or risky activities (like diving or aviation)? Read the exclusions!

❌ Assuming WorkCover Is Enough

If your employer offers life insurance, it might only be 1–2x your annual salary. Is that enough for your family’s long-term needs?

✅ Pro Tip: Supplement work cover with your policy for peace of mind.

When Should You Reassess Your Life Insurance Cover?

Life changes constantly, and your life insurance should change along with it.

Think about it:

You wouldn’t buy a car and never get it serviced, right? The same logic applies to your life insurance policy. Regular check-ins help you ensure your coverage aligns perfectly with your evolving needs.

Let’s dive into the key moments when you should reassess your cover:

📌 Key Life Events That Signal It’s Time to Review

- Birth or Adoption of a Child

- Taking On a New Mortgage or Debt

- Marriage or Divorce

- Starting or Expanding a Business

- Significant Income Changes

- Annual Policy Anniversary

✅ The Ultimate Reassessment Checklist

When you sit down to reassess your policy, use this simple checklist to make sure you’re completely covered:

- Is Your Coverage Amount Still Enough?

Consider debts, mortgages, education costs, and family expenses. A good rule of thumb is that your coverage should typically equal 10-15 times your annual income. - Are Your Beneficiaries Updated?

Confirm that your insurance payout will go directly to the people who rely on you the most. - Have You Checked Your Policy Exclusions?

Ensure you’re still comfortable with what’s excluded and that your policy covers current lifestyle risks and health conditions. - Could You Save Money by Bundling Policies?

Combining life, trauma, or medical insurance can significantly lower premiums. - Are You Taking Advantage of Loyalty or Wellness Programs?

Check for regular discounts or rewards insurers offer, especially wellness incentives that can lower your premiums.

Real-Life Example: How Mark’s Annual Check-in Saved Thousands

Mark, a 39-year-old IT consultant from Christchurch, originally bought his life insurance when he was single. After marriage and the birth of his daughter, he reassessed his policy during an annual review.

Good thing he did:

He realised his original coverage was barely enough to cover his mortgage and would leave little for his family’s long-term needs. By increasing coverage and bundling it with trauma insurance, Mark secured better protection and saved about 15% on combined premiums.

This simple annual check-in took him just a few hours but provided long-term peace of mind and substantial financial savings.

Check Compare Life Cover tools to compare life insurance cover instantly.

Why a Regular Check-in is a Smart Move (Even if Nothing Changed)

Even if your life seems unchanged, minor adjustments—like improved health status, quitting smoking, or simply ageing—can positively impact your premiums. A quick annual review might reveal opportunities to reduce costs or get additional cover for the same price.

Bottom line?

Regularly reviewing your life insurance ensures you’re always protected, optimised, and getting the best value.

Frequently Asked Questions About Choosing the Best Life Insurance Provider in New Zealand

1. How can I tell if a life insurance company is trustworthy?

Answer:

Check their financial rating from places like AM Best or Fitch. A higher rating (like “A” or “AA”) means they’re strong and more likely to pay out when needed. Trusted providers in NZ include AIA, Partners Life, Fidelity Life, and Asteron Life.

2. Can I change my life cover if my situation changes?

Answer:

Yes! You can update your policy when you get married, buy a home, or have kids. Most NZ providers let you increase cover or pause payments during tough times.

3. How often should I check or update my policy?

Answer:

A good rule of thumb is to review your coverage once a year. You should also review it after big life changes (like a new job, mortgage, or baby) to make sure you still have enough protection.

4. Are extras like funeral coverage or health rewards worth it?

Answer:

Definitely! Extras like funeral coverage, trauma insurance, and wellness rewards (like gym discounts or lower premiums if you stay healthy) can add value and save you money.

5. Can I compare different NZ life insurance companies easily?

Answer:

Yes! Use tools like Compare Life Cover to see multiple insurers side-by-side. It’s free, fast, and helps you find the best value without the guesswork.

Latest Post

- Life Insurance for Senior Citizens in NZ: The 2025 Master Guide

- AIA’s Specialist and Testing Support – New Health Benefit Explained

- How Much Life Insurance in NZ Do Kiwis Need? 2025 Expert Guide

- Life Insurance vs Mortgage Protection in NZ: Key Differences

- Best Life Insurance Policies in NZ 2025: Expert Kiwi Guide